Student loan consolidation sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with american high school hip style and brimming with originality from the outset.

Get ready to dive into the world of student loan consolidation, where we break down the ins and outs of this financial strategy in a way that’s easy to understand and oh-so-cool.

What is Student Loan Consolidation?

Student loan consolidation is the process of combining multiple student loans into a single loan, often with a lower interest rate. This can make repayment more manageable and streamline the borrowing process for students.

How Student Loan Consolidation Works

When a student consolidates their loans, a new loan is created to pay off the existing loans. This new loan typically has a fixed interest rate, which can result in lower monthly payments and potentially save money over time. Consolidation can also extend the repayment period, making it easier for students to stay on top of their payments.

Benefits of Consolidating Student Loans

- Lower Interest Rates: By consolidating multiple loans into one, students may qualify for a lower overall interest rate, which can save money in the long run.

- Single Monthly Payment: Consolidation simplifies the repayment process by combining all loans into one monthly payment, making it easier to manage finances.

- Potential for Lower Monthly Payments: Extending the repayment term through consolidation can result in lower monthly payments, providing relief to students struggling to make ends meet.

Types of Student Loan Consolidation

When it comes to student loan consolidation, there are different options available to borrowers. Let’s take a closer look at the types of student loan consolidation programs and how they compare.

Federal Student Loan Consolidation

Federal student loan consolidation is a program offered by the government to help borrowers combine multiple federal student loans into one new loan. Here are some key points to consider:

- Applicants must have federal student loans to qualify for this program.

- Interest rates are fixed and determined by a weighted average of the current interest rates on the loans being consolidated.

- Borrowers can choose from various repayment plans, including income-driven options.

- No credit check is required for federal student loan consolidation.

Private Student Loan Consolidation

Private student loan consolidation, on the other hand, involves refinancing multiple private student loans into a single private loan. Here’s what you need to know:

- Borrowers must have good credit or a cosigner to be eligible for private student loan consolidation.

- Interest rates can be fixed or variable, depending on the lender.

- Repayment options and terms vary by lender, offering more flexibility but potentially higher interest rates.

- Private consolidation may not offer the same borrower benefits and protections as federal consolidation.

Eligibility Requirements

To qualify for student loan consolidation programs, borrowers must meet certain criteria, which can vary depending on the type of consolidation. Here are some common eligibility requirements to consider:

- Being current on loan payments and not in default.

- Holding eligible student loans that can be consolidated.

- Meeting minimum loan amount thresholds set by lenders or the government.

- Having a good credit history or a cosigner for private consolidation.

- Being a U.S. citizen or eligible noncitizen for federal consolidation.

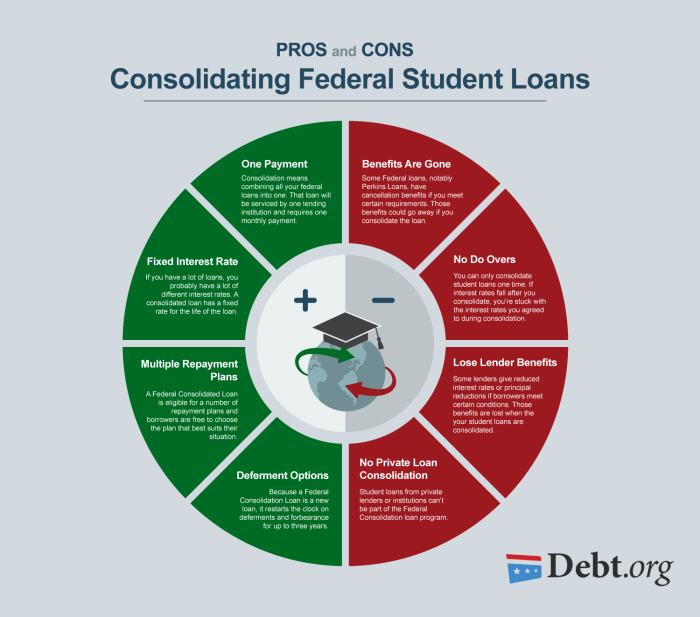

Pros and Cons of Student Loan Consolidation

When considering student loan consolidation, it’s important to weigh the advantages and disadvantages to make an informed decision about your finances.

Advantages of Student Loan Consolidation

- Streamlined Repayment: By consolidating multiple loans into one, you only have to make one monthly payment, simplifying the repayment process.

- Potential for Lower Interest Rates: Consolidation can potentially lower your interest rate, saving you money over the life of the loan.

- Flexible Repayment Options: Consolidation can offer more flexible repayment plans, such as income-driven repayment, to better suit your financial situation.

- Improved Credit Score: Managing one loan instead of multiple can help improve your credit score over time.

Disadvantages of Student Loan Consolidation

- Loss of Benefits: Consolidating federal loans into a private loan may result in losing federal loan benefits such as income-driven repayment plans or loan forgiveness programs.

- Potential for Higher Total Interest: Extending the repayment term through consolidation may result in paying more interest over the life of the loan.

- Loss of Grace Period: If you consolidate during your grace period, you may lose the remaining grace period and have to start making payments sooner.

Situations Where Student Loan Consolidation May or May Not Be Beneficial

- Beneficial: If you have multiple loans with varying interest rates and monthly payments, consolidating can simplify your finances and potentially save you money on interest.

- Not Beneficial: If you are eligible for federal loan forgiveness programs or income-driven repayment plans, consolidating federal loans into a private loan may not be in your best interest.

- Beneficial: If you are struggling to keep track of multiple loan payments and want to streamline your repayment process, consolidation can help you stay organized.

How to Consolidate Student Loans

Consolidating student loans can be a great way to simplify your repayment process and potentially save money on interest. Here’s a step-by-step guide on how to consolidate your student loans, along with tips on finding the best option for you.

Gather Documentation and Information

Before you start the student loan consolidation process, make sure you have all the necessary documentation and information ready. This may include details about your current loans, such as the types of loans, outstanding balances, and interest rates. You may also need information about your income and employment status.

- Collect information on all your existing student loans

- Have proof of income and employment status available

- Gather any other relevant financial documents

Having all the necessary information ready can help streamline the consolidation process and ensure that you provide accurate details to your loan servicer.

Explore Consolidation Options

Once you have all your documentation in order, it’s time to explore your student loan consolidation options. Research different lenders and programs to find the best option for your financial situation. Consider factors such as interest rates, repayment terms, and any potential benefits or incentives offered by the lender.

- Compare interest rates and repayment terms from different lenders

- Look for any special benefits or incentives offered by loan consolidation programs

- Read reviews and do thorough research before making a decision

Exploring your options allows you to find the most favorable terms for your consolidated loan, potentially saving you money in the long run.

Apply for Consolidation

Once you’ve chosen a lender or consolidation program, you can proceed with the application process. Submit all required documentation and information accurately to avoid any delays in the consolidation process. Be prepared to provide any additional details or documents as requested by the lender.

- Fill out the consolidation application form completely and accurately

- Submit all required documentation, such as income verification and loan details

- Follow up with the lender if necessary and respond promptly to any requests for information

Submitting a thorough and accurate application can help expedite the consolidation process and ensure that your new consolidated loan reflects your current financial situation.

Impact on Loan Repayment

When you consolidate your student loans, it can have a significant impact on your loan repayment terms. This can affect the amount you pay each month, the length of your repayment period, and the overall cost of your loans.

How Interest Rates are Determined in Student Loan Consolidation

In student loan consolidation, the interest rate on your new consolidated loan is determined by taking the weighted average of the interest rates on all the loans being consolidated. This means that if you have loans with varying interest rates, the new interest rate will be somewhere in between.

- For example, if you have one loan with a 5% interest rate and another with a 7% interest rate, the weighted average interest rate on your consolidated loan would be closer to 6%.

- Keep in mind that federal student loan consolidation does not lower your interest rate but rather simplifies your repayment process.

Examples of How Student Loan Consolidation Can Affect Monthly Payments

When you consolidate your student loans, the new repayment term can be extended, resulting in lower monthly payments. However, extending the repayment term also means you’ll end up paying more in interest over the life of the loan.

- For instance, if you had a 10-year repayment plan on your original loans but opt for a 20-year repayment plan through consolidation, your monthly payments will be lower but you’ll end up paying more in interest over the 20 years.

- On the other hand, if you choose a shorter repayment term through consolidation, your monthly payments may increase, but you’ll pay less in interest overall.