Embark on a journey to demystify the world of financial statements. From decoding balance sheets to unraveling income statements, this guide will equip you with the knowledge needed to navigate the intricate web of financial data.

Get ready to dive deep into the realm of financial analysis and gain insights that will empower you to make informed decisions in the realm of investments and business operations.

Introduction to Financial Statements

Financial statements are crucial documents that provide a snapshot of a company’s financial performance and position. They are essential for investors, creditors, and other stakeholders to assess the health and stability of a business.

Purpose of Financial Statements

Financial statements serve the purpose of presenting the financial information of a company in a structured and understandable manner. They help in evaluating the profitability, liquidity, and solvency of a business.

- Income Statement: Also known as the Profit and Loss Statement, it shows the company’s revenues, expenses, and profits over a specific period.

- Balance Sheet: This statement provides a snapshot of the company’s assets, liabilities, and shareholder’s equity at a particular point in time.

- Cash Flow Statement: It details the inflow and outflow of cash within the business, showing how the company generates and uses cash.

Importance of Understanding Financial Statements

Investors and stakeholders rely on financial statements to make informed decisions about the company. By analyzing these statements, they can assess the company’s financial health, growth potential, and overall performance. Understanding financial statements is crucial for investors to determine whether to invest in a company or for creditors to assess the company’s creditworthiness.

Components of Financial Statements

Financial statements consist of three main components: the balance sheet, income statement, and cash flow statement. Each provides valuable information about a company’s financial health and performance.

Balance Sheet

The balance sheet, also known as the statement of financial position, provides a snapshot of a company’s assets, liabilities, and shareholders’ equity at a specific point in time. It is divided into two main sections:

- Assets: These are resources owned or controlled by the company, such as cash, inventory, property, and equipment.

- Liabilities: These are obligations or debts that the company owes to external parties, such as loans, accounts payable, and bonds.

- Shareholders’ Equity: This represents the company’s net assets or the amount of money that would be left for shareholders after settling all liabilities.

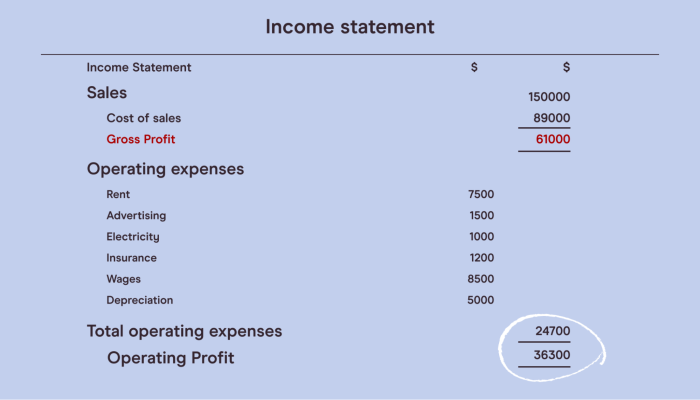

Income Statement

The income statement, also known as the profit and loss statement, shows a company’s revenues, expenses, and net income over a specific period, typically a quarter or a year. It helps investors and analysts assess the company’s profitability and performance. The main components of an income statement include:

- Revenue: The total amount of money generated from sales of goods or services.

- Expenses: The costs incurred to generate revenue, such as salaries, rent, utilities, and marketing expenses.

- Net Income: The difference between revenue and expenses, indicating the company’s profitability.

Cash Flow Statement

The cash flow statement shows how cash flows in and out of a company during a specific period, providing insights into its liquidity and ability to meet financial obligations. It is divided into three main sections:

- Cash Flow from Operating Activities: Shows the cash generated from the company’s core business operations.

- Cash Flow from Investing Activities: Shows the cash used for investments in assets such as property, equipment, or securities.

- Cash Flow from Financing Activities: Shows the cash flow related to external financing, such as issuing or repurchasing stock, borrowing, or repaying debt.

Reading a Balance Sheet

When analyzing a balance sheet, it is important to understand how assets, liabilities, and equity are presented and how key ratios or metrics are derived from the data provided.

Understanding Assets, Liabilities, and Equity

On a balance sheet, assets are listed first and typically include items such as cash, inventory, property, and equipment. Liabilities come next and encompass debts and obligations owed by the company. Finally, equity represents the owner’s claim on the assets of the business.

Key Ratios and Metrics

- Debt-to-Equity Ratio: This ratio compares a company’s total debt to its total equity, indicating the level of financial leverage used by the business.

- Current Ratio: Calculated by dividing current assets by current liabilities, this ratio helps assess a company’s ability to cover its short-term obligations.

- Return on Equity (ROE): ROE measures a company’s profitability by revealing how much profit a company generates with the money shareholders have invested.

- Working Capital Ratio: This ratio reflects a company’s ability to cover its short-term liabilities with its short-term assets.

Analyzing an Income Statement

When it comes to analyzing an income statement, it is crucial to understand the financial performance of a company over a specific period. The income statement provides valuable insights into the revenue generated, expenses incurred, and the resulting net income.

Significance of Revenue, Expenses, and Net Income

- Revenue: Revenue represents the total amount of money earned by the company through its core business operations. It is a key indicator of the company’s ability to generate income.

- Expenses: Expenses refer to the costs incurred by the company to operate and maintain its business. These include both operating expenses (such as salaries, rent, and utilities) and non-operating expenses (such as interest payments).

- Net Income: Net income, also known as the bottom line, is the amount left after deducting expenses from revenue. It indicates the profitability of the company.

Calculating Profitability Ratios

To assess the financial health and performance of a company, various profitability ratios can be calculated using data from the income statement:

- Gross Profit Margin = (Gross Profit / Revenue) x 100

- Net Profit Margin = (Net Income / Revenue) x 100

- Return on Assets (ROA) = Net Income / Average Total Assets

- Return on Equity (ROE) = Net Income / Average Shareholders’ Equity

Profitability ratios help investors and analysts evaluate the company’s ability to generate profits from its operations and make informed investment decisions.

Understanding a Cash Flow Statement

When it comes to assessing a company’s financial health, understanding a cash flow statement is crucial. This statement provides valuable information about how cash is being generated and used within a specific period of time.

Purpose of a Cash Flow Statement

The cash flow statement helps investors, creditors, and analysts evaluate a company’s ability to generate cash and meet its financial obligations. It provides insights into the actual cash inflows and outflows, which may not be evident from the balance sheet or income statement alone.

Sections of a Cash Flow Statement

- Cash Flow from Operating Activities: This section shows the cash generated or used in the company’s core business operations. It includes items like sales revenue, operating expenses, and changes in working capital.

- Cash Flow from Investing Activities: Here, you’ll find information about cash spent on investments, such as purchasing or selling assets like property, plant, and equipment.

- Cash Flow from Financing Activities: This section details cash flows related to financing activities, such as issuing or repurchasing stock, paying dividends, or taking out loans.

Using Cash Flow Information for Financial Health Assessment

By analyzing the cash flow statement, stakeholders can assess a company’s liquidity, solvency, and overall financial stability. Positive cash flow from operating activities indicates that the company is generating enough cash to support its operations, while negative cash flow may signal potential financial troubles.