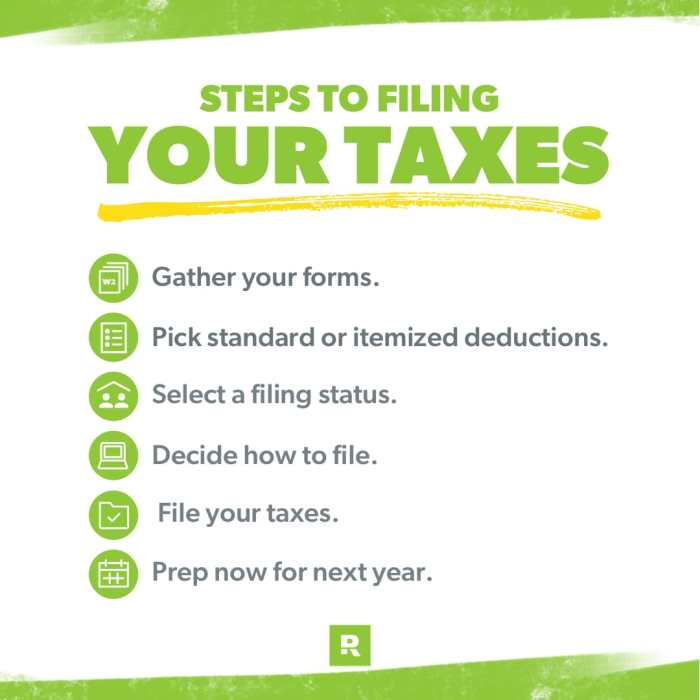

Ready to tackle the world of tax filing? In this guide, we’ll break down everything you need to know about how to file taxes, from understanding the basics to maximizing deductions and credits. So, grab your calculator and let’s dive in!

Tax season can be overwhelming, but with the right knowledge and preparation, you can conquer your taxes like a pro.

Understanding Tax Filing

When it comes to tax filing, it refers to the process of submitting your income tax return to the government, detailing your earnings, deductions, and overall financial situation for the year.

It is crucial to file your taxes accurately and on time to comply with the law and avoid penalties. Filing taxes also ensures that you are paying the correct amount of tax owed based on your income and expenses.

Importance of Filing Taxes

- Filing taxes helps fund essential government services such as schools, roads, and public safety.

- It allows you to claim deductions and credits that can lower your tax bill and potentially increase your refund.

- Not filing taxes can result in penalties, interest, and legal consequences, including fines or even criminal charges.

Consequences of Not Filing Taxes

- Accumulation of penalties and interest on the unpaid taxes.

- Risk of having a tax lien placed on your property or assets.

- Potential loss of eligibility for certain tax benefits or credits in the future.

Required Documents

When filing your taxes, it’s crucial to have all the necessary documents in hand to ensure accuracy and compliance with tax laws. These documents provide vital information needed to report your income, deductions, and credits properly.

W-2 Forms

- Employers are required to provide employees with a W-2 form, which Artikels the total wages earned and taxes withheld during the year.

- You can obtain your W-2 form from your employer by the end of January each year.

1099 Forms

- Freelancers, independent contractors, or individuals who receive income from sources other than an employer will receive a 1099 form.

- These forms report non-employee compensation, interest, dividends, or other types of income received.

1098 Forms

- If you paid mortgage interest, student loan interest, or tuition fees during the year, you may receive a 1098 form.

- These forms are essential for claiming deductions related to homeownership, education expenses, and student loan interest.

Receipts for Deductions

- Keep all receipts and records for expenses you plan to deduct, such as medical expenses, charitable donations, or business expenses.

- These receipts are necessary to support your claims and ensure you receive the deductions you are entitled to.

Previous Year’s Tax Return

- Having a copy of your previous year’s tax return can be helpful in referencing important information or carryover items for the current year.

- It can also serve as a guide to ensure consistency in reporting and prevent errors.

Tax Deductions and Credits

When it comes to filing taxes, understanding the difference between tax deductions and tax credits is crucial. Tax deductions reduce the amount of income that is subject to taxation, while tax credits directly reduce the amount of tax owed.

Tax Deductions

Tax deductions lower your taxable income, which in turn reduces the amount of tax you owe. Some common deductions that individuals can claim include:

- Mortgage interest

- Charitable contributions

- Medical expenses

Tax Credits

Tax credits, on the other hand, directly reduce the amount of tax you owe. Some common tax credits that individuals can claim include:

- Child Tax Credit

- Earned Income Tax Credit

- American Opportunity Tax Credit

Lowering Tax Liability

Both deductions and credits can help lower your tax liability. Deductions reduce the amount of income that is subject to tax, while credits directly reduce the amount of tax owed. By taking advantage of deductions and credits, you can potentially decrease the amount of tax you owe and maximize your tax refund.

Filing Options

When it comes to filing your taxes, you have a few different options to choose from. Each method has its own advantages and disadvantages, so it’s important to consider your individual circumstances before deciding on the best filing option for you.

Online Filing

Online filing, also known as e-filing, is a convenient and efficient way to submit your tax return. Many tax preparation software programs are available to help guide you through the process, making it easier to file accurately and quickly.

- Advantages:

- Fast and secure submission

- Automatic calculation of deductions and credits

- Immediate confirmation of receipt

- Disadvantages:

- May not be suitable for complex tax situations

- Some software programs may have fees

- Limited access to personalized assistance

Paper Forms

Filing taxes using paper forms is the traditional method that involves filling out physical forms and mailing them to the IRS. While it may take longer than online filing, some individuals prefer this method for various reasons.

- Advantages:

- No need for internet access

- Greater control over the process

- No software fees

- Disadvantages:

- Slower processing time

- Higher chance of errors

- Lack of immediate confirmation

Tax Professional

Hiring a tax professional, such as a certified public accountant (CPA) or tax preparer, can provide personalized assistance and expertise in handling your tax return. This option is beneficial for those with complex tax situations or those who prefer professional guidance.

- Advantages:

- Expert advice and guidance

- Help with tax planning and strategies

- Assistance in case of audits or inquiries

- Disadvantages:

- Higher cost compared to DIY methods

- Dependence on availability of professionals

- Potential for miscommunication or errors

Deadline and Extensions

When it comes to filing your taxes, it’s crucial to be aware of the deadline. The tax filing deadline in the United States is typically April 15th of each year. This means that you must submit your tax return by this date to avoid any penalties or late fees.

Requesting a Filing Extension

If for some reason you are unable to file your taxes by the April 15th deadline, you have the option to request a filing extension. To do this, you must fill out IRS Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. This form will give you an additional six months to submit your tax return, moving the deadline to October 15th.

- It’s important to note that while an extension gives you more time to file your return, it does not grant you an extension on paying any taxes owed. You are still required to estimate and pay any taxes due by the original deadline of April 15th to avoid penalties and interest.

- Submitting Form 4868 is relatively straightforward and can be done electronically or by mail. Be sure to file for an extension before the original deadline to avoid any late filing penalties.

Penalties for Filing Late

If you fail to file your tax return or request an extension by the April 15th deadline, you may face penalties and fees. The penalty for filing late is typically 5% of the unpaid taxes for each month your return is overdue, up to a maximum of 25%.

It’s crucial to be aware of the tax filing deadline and to request an extension if needed to avoid penalties and fees.

Tax Filing Tips

Organizing your tax-related documents throughout the year is crucial for a smooth tax filing process. By keeping everything in one place and staying organized, you can avoid last-minute scrambling and ensure you have all the necessary information when it’s time to file.

Maximizing Deductions and Credits

When it comes to maximizing deductions and credits, make sure you’re aware of all the tax breaks available to you. Keep track of any expenses that may be deductible, such as medical expenses, charitable donations, or business expenses. Additionally, consider contributing to retirement accounts or health savings accounts to lower your taxable income and potentially qualify for additional tax credits.

- Keep receipts and documentation for all deductible expenses

- Take advantage of tax credits for education expenses, child care, or energy-efficient home improvements

- Consider consulting with a tax professional to ensure you’re taking full advantage of all available deductions and credits

Common Errors to Avoid

Avoiding common errors when filing taxes can save you time and prevent potential penalties. Be sure to double-check all your information for accuracy, including your Social Security number, income figures, and deductions. Additionally, make sure to file on time and consider filing electronically for a quicker and more secure process.

- Avoid math errors by using tax software or double-checking your calculations

- Don’t forget to sign and date your return before submitting

- Be cautious of identity theft scams and only provide personal information on secure websites

Tax Refunds

When it comes to tax refunds, it’s important to understand how they work and the different ways you can receive them. Here’s a breakdown of everything you need to know:

How Tax Refunds Work

- Once you file your taxes and the IRS processes your return, if you’ve paid more in taxes throughout the year than you owe, you will receive a tax refund.

- This refund is essentially the government returning the extra money you paid back to you.

- It’s important to note that receiving a tax refund means you overpaid your taxes, so it’s a good idea to adjust your withholding to avoid overpaying in the future.

Ways to Receive a Tax Refund

- Direct Deposit: Opting for direct deposit is the fastest way to receive your tax refund. You can have the money deposited directly into your bank account.

- Check: If you prefer not to use direct deposit, you can choose to receive a paper check in the mail. Keep in mind that this option may take longer to receive.

- Prepaid Debit Card: Some taxpayers can receive their refund on a prepaid debit card, which can be a convenient option for those without a bank account.

Tips for Tracking Tax Refund Status

- Use the “Where’s My Refund?” tool on the IRS website to check the status of your tax refund.

- Make sure to have your social security number, filing status, and exact refund amount on hand to access your refund status.

- Check regularly for updates, as the IRS updates the tool once a day usually.