How to calculate net worth sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset.

Net worth is more than just a number; it’s a reflection of your financial health and a key aspect of financial planning. Understanding how to calculate net worth can provide valuable insights into your overall financial well-being.

Introduction to Net Worth Calculation

Net worth is a financial metric that represents the difference between a person’s assets and liabilities. It is a crucial indicator of an individual’s financial health and provides insight into their overall financial situation.

In personal finance, net worth serves as a measure of wealth accumulation and financial stability. By calculating net worth, individuals can assess their progress towards financial goals, identify areas for improvement, and make informed decisions about budgeting, saving, and investing.

Calculating net worth is essential for financial health as it offers a comprehensive view of one’s financial standing. It helps individuals track their financial progress over time, evaluate their debt-to-asset ratio, and determine their ability to cover expenses, manage debt, and achieve long-term financial security.

Components of Net Worth

When calculating net worth, it’s essential to consider the key components that contribute to the final figure. Assets and liabilities play a crucial role in determining an individual’s or entity’s net worth. Let’s delve into how these elements are categorized and their significance in the net worth calculation.

Assets and Liabilities

Assets and liabilities are the cornerstone of net worth calculation. Assets represent everything owned by an individual or entity that holds economic value, while liabilities are debts or obligations that need to be paid. The difference between total assets and total liabilities gives the net worth.

- Assets: Assets can be categorized into two main types: tangible assets and intangible assets. Tangible assets include physical properties like real estate, vehicles, and equipment. Intangible assets, on the other hand, encompass non-physical assets such as patents, trademarks, and goodwill.

- Liabilities: Liabilities are classified into current liabilities and long-term liabilities. Current liabilities are short-term debts that need to be settled within a year, such as credit card bills and utility payments. Long-term liabilities, on the other hand, are debts with a longer repayment period, like mortgages and business loans.

Calculating Assets

When determining your net worth, it’s crucial to accurately calculate your assets. Assets are anything of value that you own, which can include real estate, investments, personal property, and more. Let’s break down how to calculate the value of these assets for a comprehensive net worth assessment.

Common Assets in Net Worth Calculation

- Real Estate: This includes the value of any properties you own, such as your primary residence, vacation homes, rental properties, or land.

- Investments: This encompasses stocks, bonds, retirement accounts, mutual funds, and any other financial assets you hold.

- Personal Property: Items like vehicles, jewelry, electronics, furniture, and collectibles all contribute to your overall net worth.

Determining Asset Values

To accurately assess the worth of your assets for financial planning, you can use the following strategies:

- Real Estate: Obtain a current market valuation through a professional appraisal, recent comparable sales, or online real estate platforms.

- Investments: Determine the current market value of your investments by checking stock prices, account statements, or consulting with a financial advisor.

- Personal Property: Evaluate the fair market value of personal items by researching similar items for sale online, considering depreciation, or getting expert opinions for high-value pieces.

Strategies for Accurate Asset Assessment

- Regular Updates: Keep track of your asset values and update them periodically to reflect any changes in market conditions or the condition of your assets.

- Professional Help: Consider consulting with financial advisors, real estate agents, or appraisers to ensure accurate valuations for complex assets.

- Documentation: Maintain records, receipts, and appraisals for your assets to support their values in case of audits or financial planning reviews.

Calculating Liabilities

When it comes to calculating net worth, understanding your liabilities is just as important as knowing your assets. Liabilities are debts, loans, or financial obligations that you owe to others, and they play a crucial role in determining your overall net worth.

Types of Liabilities

There are different types of liabilities that can impact your net worth calculations:

- Credit card debt

- Student loans

- Mortgages

- Car loans

- Personal loans

- Medical bills

Accounting for Liabilities

When calculating your net worth, be sure to account for all your liabilities by subtracting them from your total assets. This will give you a clearer picture of your financial standing.

Formula:

Net Worth = Total Assets – Total Liabilities

Managing Liabilities

To improve your overall net worth, consider these tips for managing your liabilities:

- Create a budget and stick to it to avoid accumulating more debt.

- Pay off high-interest debts first to reduce the amount of interest you pay over time.

- Negotiate with creditors for lower interest rates or payment plans if you’re struggling to make payments.

- Avoid taking on new debts unless absolutely necessary to prevent further financial strain.

- Consider debt consolidation or refinancing options to streamline your debt payments and potentially lower interest rates.

Net Worth Formula

Calculating your net worth is a simple yet essential financial exercise. The formula for determining your net worth is straightforward:

Net Worth = Assets – Liabilities

. Let’s break down this formula step by step to understand how it works in practical scenarios.

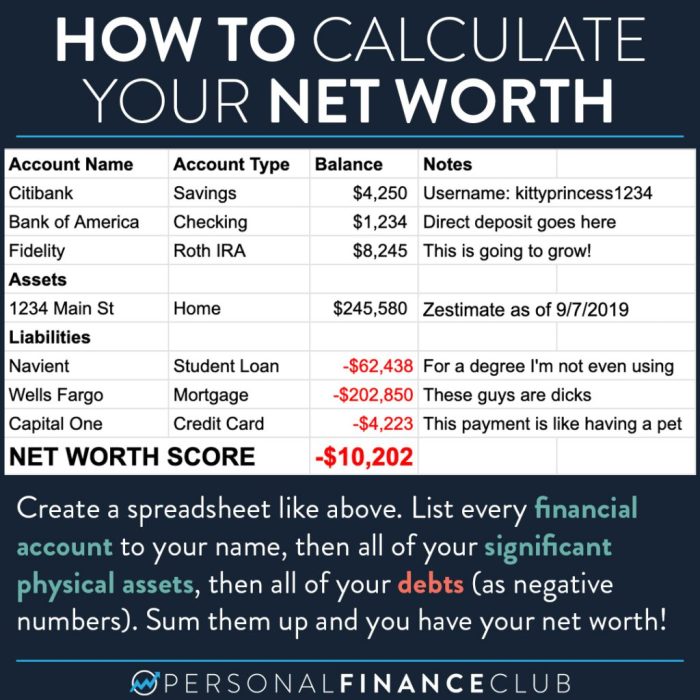

Step-by-Step Breakdown

- Start by listing down all your assets, including cash, investments, real estate, vehicles, and valuable possessions.

- Calculate the total value of your assets by adding up all the individual values.

- Next, list down all your liabilities, such as mortgage, student loans, credit card debt, and any other outstanding debts.

- Calculate the total value of your liabilities by adding up all the individual amounts.

- Subtract the total liabilities from the total assets to arrive at your net worth.

Practical Examples

- Example 1: If your total assets amount to $500,000 and your total liabilities amount to $200,000, your net worth would be $500,000 – $200,000 = $300,000.

- Example 2: If your total assets amount to $1,000,000 and your total liabilities amount to $1,200,000, your net worth would be $1,000,000 – $1,200,000 = -$200,000 (indicating negative net worth).