Yo, diving into compound interest calculator, this intro hooks you in with a fresh take on finance. Explaining the ins and outs of compound interest in a way that’s easy to digest, we’re about to break it down like never before.

Get ready to level up your financial knowledge with this comprehensive guide.

Introduction to Compound Interest Calculator

Compound interest is when interest is calculated not only on the initial principal but also on the accumulated interest from previous periods. This means that with compound interest, you earn interest on your interest, resulting in exponential growth of your investment over time.

A compound interest calculator is a tool that helps you determine how much your initial investment will grow over a specific period of time, taking into account the interest rate and the frequency of compounding. It is important because it allows you to see the power of compound interest and make informed decisions about your investments.

Difference between Compound Interest and Simple Interest

Compound interest differs from simple interest in that with simple interest, you only earn interest on the principal amount. This means that your interest remains constant throughout the investment period, whereas with compound interest, your interest grows exponentially as it is calculated on both the principal and the accumulated interest.

How Compound Interest Calculators Work

Compound interest calculators are powerful tools that help individuals understand how their investments grow over time. By using a formula that takes into account the initial principal, interest rate, compounding frequency, and time period, these calculators can provide accurate projections of future earnings.

Formula for Calculating Compound Interest

Compound interest is calculated using the formula:

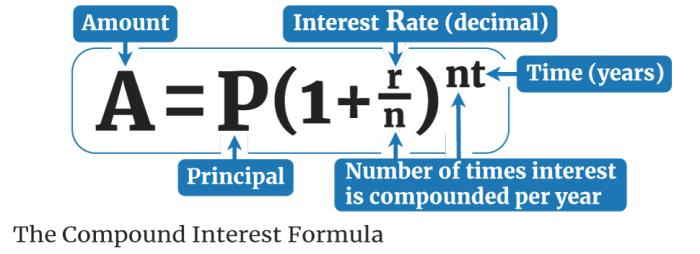

A = P(1 + r/n)^(nt)

Where:

- A = the future value of the investment

- P = the principal amount (initial investment)

- r = annual interest rate (in decimal form)

- n = number of times interest is compounded per year

- t = number of years the money is invested for

Step-by-Step Guide to Using a Compound Interest Calculator

Using a compound interest calculator is simple and straightforward. Here’s a step-by-step guide:

- Enter the initial principal amount (P) into the designated field.

- Input the annual interest rate (r) as a decimal value.

- Specify the compounding frequency (n) per year.

- Enter the number of years (t) you plan to invest for.

- Click on the “Calculate” button to see the future value of your investment.

Variables Involved in Compound Interest Calculations

Several key variables play a crucial role in compound interest calculations:

- Principal (P): The initial amount of money invested.

- Interest Rate (r): The annual rate at which the investment grows, expressed as a decimal.

- Compounding Frequency (n): The number of times interest is compounded per year.

- Time Period (t): The duration for which the money is invested.

Types of Compound Interest Calculators

Compound interest calculators come in different types to suit various financial needs and preferences. Let’s explore the different types available and how they can be useful in calculating compound interest.

Online vs. Offline Compound Interest Calculators

Online compound interest calculators are web-based tools that can be accessed through a browser, while offline calculators are software programs that need to be downloaded and installed on a device. Online calculators offer the convenience of accessibility from anywhere with an internet connection, while offline tools provide the advantage of privacy and security as they don’t require an internet connection.

Daily, Monthly, and Yearly Compounding Calculators

Daily compounding calculators calculate interest accrued daily, taking into account the principal amount and interest earned each day. Monthly compounding calculators, on the other hand, calculate interest on a monthly basis, considering the principal amount and interest earned each month. Yearly compounding calculators calculate interest annually, factoring in the principal amount and interest earned each year. The frequency of compounding can affect the total amount of interest earned over time.

Specialized Compound Interest Calculators

There are specialized compound interest calculators designed for specific financial purposes, such as retirement planning, loan repayment calculations, and investment growth projections. These calculators may include additional features and inputs tailored to the specific financial goal, providing more accurate and detailed results for the user’s needs.

Benefits and Limitations of Using Compound Interest Calculators

Compound interest calculators offer several advantages for individuals looking to plan their finances effectively. These calculators can help individuals make informed decisions about saving and investing by providing accurate projections of how their money will grow over time. By utilizing compound interest calculators, individuals can visualize the impact of saving and investing early, as well as the benefits of compound growth.

Advantages of Using Compound Interest Calculators

- Accurate Projections: Compound interest calculators provide precise estimates of how investments will grow over time, helping individuals set realistic financial goals.

- Comparison Tool: These calculators allow users to compare different investment options and savings strategies to determine the most profitable approach.

- Time-Saving: Instead of manually calculating compound interest, individuals can quickly obtain results through these calculators, saving time and effort.

- Financial Awareness: By using compound interest calculators, individuals can better understand the power of compound growth and the importance of starting to save early.

Limitations of Using Compound Interest Calculators

- Assumption of Constant Rates: Compound interest calculators often assume a constant rate of return, which may not reflect the actual fluctuations in the market.

- Ignored External Factors: These calculators do not account for external factors such as inflation, taxes, or market volatility, which can significantly impact investment returns.

- Overconfidence: Relying solely on compound interest calculators may lead individuals to overestimate their potential returns and take on excessive risk in their investments.

Tips to Maximize the Benefits of Using a Compound Interest Calculator

- Use Realistic Assumptions: Adjust the inputs in the calculator to reflect realistic rates of return and account for external factors that may influence investment growth.

- Regularly Update Inputs: Update the calculator periodically with current information to ensure that projections remain accurate and aligned with market conditions.

- Consult a Financial Advisor: While compound interest calculators are useful tools, seeking advice from a financial advisor can provide personalized recommendations based on individual financial goals and risk tolerance.