Diving into the world of investing in index funds, this intro sets the stage for a thrilling exploration of financial opportunities. Get ready to level up your investment game!

Index funds, a key player in the investment realm, offer unique advantages and potential for growth. Let’s uncover the secrets to success in this dynamic market.

Introduction to Index Funds

Index funds are a type of mutual fund or exchange-traded fund (ETF) that aims to track the performance of a specific market index, such as the S&P 500. These funds are designed to provide investors with a diversified portfolio of stocks or bonds that mimic the returns of the overall market.

Passive investing is a strategy where investors buy and hold a diversified portfolio of assets with the goal of matching the returns of a specific index, rather than trying to beat the market through active trading. Index funds are a popular choice for passive investors because they offer low fees, broad diversification, and consistent returns over the long term.

Popular Index Funds and Tracking Indexes

- Vanguard Total Stock Market Index Fund (VTSAX) – Tracks the performance of the CRSP US Total Market Index, which includes nearly 3,500 stocks of all sizes.

- S&P 500 Index Fund – Tracks the performance of the S&P 500 index, which consists of 500 large-cap U.S. stocks.

- iShares Core MSCI Emerging Markets ETF (IEMG) – Tracks the performance of the MSCI Emerging Markets Index, which includes stocks from developing economies.

Benefits of Investing in Index Funds

Index funds are a popular choice among investors for several reasons. Let’s explore the advantages they offer over actively managed funds.

Lower Costs

Index funds typically have lower fees compared to actively managed funds. Since they aim to replicate a specific market index rather than actively pick and choose investments, the costs associated with managing these funds are reduced. This can result in higher returns for investors in the long run.

Diversification

One of the key benefits of investing in index funds is the built-in diversification they provide. By tracking a broad market index, investors are able to spread their risk across a wide range of companies and industries. This can help mitigate the impact of volatility in any one particular stock and potentially improve overall portfolio stability.

Consistent Returns

Index funds are known for their potential to deliver consistent returns over the long term. Since they aim to mirror the performance of a market index, investors can benefit from the overall growth of the market without trying to outperform it. This passive approach can lead to steady and reliable returns, making index funds a popular choice for those looking to build wealth gradually.

How to Choose Index Funds

When selecting index funds, it is crucial to consider your investment goals and risk tolerance to ensure you choose the most suitable options. Additionally, factors such as expense ratios, tracking errors, historical performance, and fund size play a significant role in making an informed decision.

Criteria for Selecting Suitable Index Funds

- Identify your investment goals: Determine whether you are looking for growth, income, or a balanced approach to align with your financial objectives.

- Evaluate your risk tolerance: Understand how much risk you are willing to take on and choose index funds that match your comfort level.

Importance of Considering Expense Ratios and Tracking Errors

- Expense ratios: Lower expense ratios can lead to higher returns over time, so it is essential to compare and select index funds with competitive fees.

- Tracking errors: Look for index funds with minimal tracking errors to ensure that the fund closely mirrors the performance of its benchmark index.

Tips on Evaluating Historical Performance and Fund Size

- Historical performance: Review the past performance of index funds to assess their consistency and ability to meet your investment objectives.

- Fund size: Consider the size of the index fund as larger funds may offer more stability and liquidity, but smaller funds could potentially provide higher growth opportunities.

Risks and Limitations of Index Fund Investing

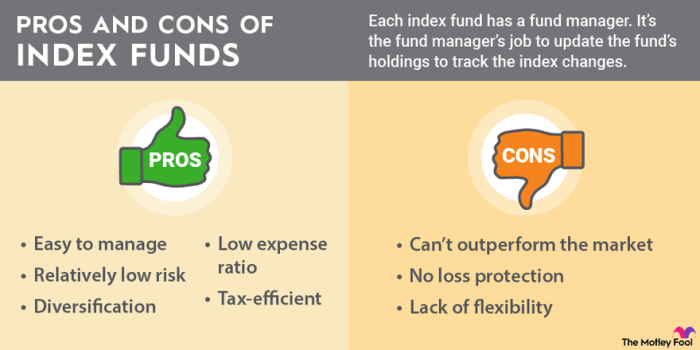

Investing in index funds comes with its own set of risks and limitations that investors should be aware of. While index funds are generally considered lower risk compared to individual stock picking, there are still potential downsides to be mindful of.

When considering index fund investing, it’s important to understand the following risks and limitations:

Market Volatility and Lack of Flexibility

Market volatility can have a significant impact on index fund investments. Since index funds aim to mirror the performance of a particular index, they are susceptible to market fluctuations. This lack of flexibility means that investors may not be able to quickly react to changing market conditions or individual stock performances.

Impact of Market Downturns

During market downturns, index fund returns can be negatively affected. As index funds hold a diversified portfolio of stocks within a specific index, a downturn in the overall market can lead to decreased returns for investors. It’s essential to be prepared for potential fluctuations in value during economic downturns.

Over-Diversification and Limited Potential Gains

While diversification is a key benefit of index fund investing, over-diversification can sometimes limit potential gains. Holding too many stocks within an index fund can dilute the impact of top-performing stocks on the overall performance of the fund. Investors should strike a balance between diversification and concentration to maximize potential returns.

Overall, understanding the risks and limitations of index fund investing is crucial for making informed investment decisions and managing expectations in the market.

Tax Implications of Investing in Index Funds

When it comes to investing in index funds, it’s essential to consider the tax implications that may arise. Understanding how capital gains taxes apply, the difference between short-term and long-term capital gains, and tax-efficient strategies can help you make informed decisions about your investments.

Capital Gains Taxes

Capital gains taxes are applicable to index fund investments when you sell your shares for a profit. The amount of tax you owe depends on how long you held the investment before selling.

Short-term vs. Long-term Capital Gains

Short-term capital gains apply to investments held for one year or less, and they are taxed at your ordinary income tax rate. On the other hand, long-term capital gains are for investments held for more than a year, and they are taxed at a lower rate, typically ranging from 0% to 20% depending on your income level.

Tax-efficient Strategies

One tax-efficient strategy for managing index fund investments is to hold onto your shares for the long term to take advantage of lower long-term capital gains tax rates. Another strategy is tax-loss harvesting, where you sell investments that have lost value to offset gains in other investments, reducing your overall tax liability.