When it comes to building wealth, the age-old debate between real estate and stocks has always been a hot topic. Both avenues offer unique opportunities and challenges that investors must navigate. Let’s dive into the fundamental disparities between these two investment options and shed light on the risks and rewards associated with each.

Real Estate vs Stocks

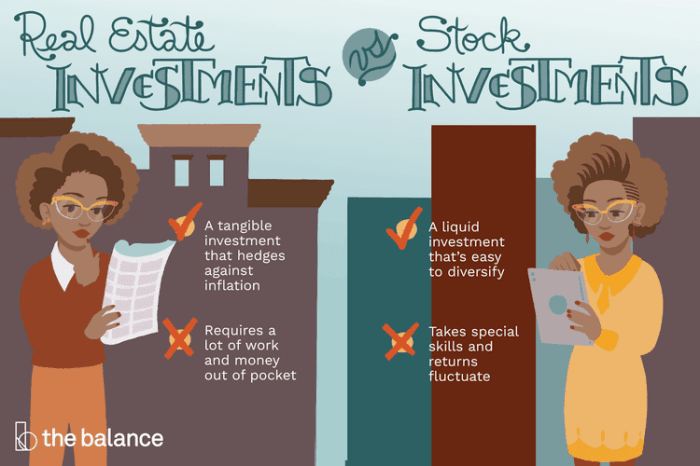

Investing in real estate and investing in stocks are two popular ways to grow wealth, but they have fundamental differences in terms of how they operate, the risks involved, and the potential returns on investment.

Fundamental Differences

- Real Estate: Involves purchasing physical properties like houses, apartments, or commercial buildings. Investors can generate income through rent or property appreciation.

- Stocks: Involves buying shares of a company, representing ownership in the business. Investors can earn money through dividends or selling shares at a higher price.

Risks Associated

- Real Estate: Risks include property damage, vacancies, and market fluctuations. It requires ongoing maintenance and can be illiquid, meaning it may be challenging to sell quickly.

- Stocks: Risks involve market volatility, company performance, and economic factors. Stock prices can fluctuate rapidly, and investors may experience losses if the company underperforms.

Potential Returns on Investment

- Real Estate: Offers potential for steady cash flow through rental income and long-term appreciation of property value. It can provide a hedge against inflation and tax benefits.

- Stocks: Provide opportunities for capital appreciation as the company grows and increases in value. Some stocks also pay dividends, providing a source of passive income.

Real Estate Investment

Investing in real estate can be done in various ways, each offering unique benefits and risks. Whether it’s through owning rental properties, investing in Real Estate Investment Trusts (REITs), or participating in real estate crowdfunding, there are options for all types of investors.

Rental Properties

- Owning rental properties allows investors to generate income through monthly rent payments.

- Property value appreciation over time can lead to significant returns on investment.

- Tax deductions on mortgage interest, property taxes, and operating expenses can help reduce taxable income.

Real Estate Investment Trusts (REITs)

- REITs provide an opportunity to invest in real estate without directly owning physical properties.

- Investors can benefit from regular dividend payments and potential capital appreciation.

- REITs offer diversification and liquidity, making it easier to invest in real estate with lower capital requirements.

Real Estate Crowdfunding

- Crowdfunding platforms allow investors to pool funds together to invest in real estate projects.

- Investors can access a wider range of real estate opportunities with lower investment amounts.

- Potential for higher returns compared to traditional investment methods.

Advantages of Real Estate Investment over Stocks

- Tangible Asset: Real estate provides a physical asset that can potentially appreciate over time.

- Income Generation: Rental properties offer a steady stream of income through rent payments.

- Diversification: Real estate can help diversify an investment portfolio beyond stocks and bonds.

Tax Benefits of Investing in Real Estate

- Depreciation Deduction: Investors can deduct a portion of the property’s value each year as depreciation, reducing taxable income.

- 1031 Exchange: Allows investors to defer capital gains taxes by reinvesting proceeds from a property sale into a similar property.

- Mortgage Interest Deduction: Deducting mortgage interest payments can lower taxable income for property owners.

Stocks Investment

Investing in stocks offers a variety of options for investors to consider. Understanding the different types of stocks available, the liquidity of stocks compared to real estate investments, and the impact of market volatility is crucial for making informed investment decisions.

Types of Stocks

- Common Stocks: Common stocks represent ownership in a company and typically come with voting rights at shareholder meetings. Investors can benefit from capital appreciation and dividends.

- Preferred Stocks: Preferred stocks come with a fixed dividend payment and are prioritized over common stocks in terms of dividend distribution. However, preferred stockholders usually do not have voting rights.

- Blue-Chip Stocks: Blue-chip stocks are shares of well-established, financially stable companies with a history of reliable performance. These stocks are considered less volatile and are often seen as a safe investment choice.

Stock Liquidity

Stocks are highly liquid investments, as they can be easily bought and sold on the stock market. Investors have the flexibility to trade stocks quickly, allowing for easy access to their funds compared to real estate investments, which may take longer to sell.

Market Volatility Impact

Market volatility can have a significant impact on stock investments. During periods of high volatility, stock prices can fluctuate rapidly, leading to potential gains or losses for investors. It is important for investors to carefully monitor market conditions and make informed decisions to navigate through volatile periods.

Risk Management

When it comes to investing in real estate, there are several strategies you can use to manage risks effectively. One key strategy is to conduct thorough research on the property and the market to ensure you are making an informed decision. Additionally, having a buffer fund for unexpected expenses can help mitigate financial risks. Utilizing insurance coverage and working with a professional property manager can also help protect your investment.

Utilizing Diversification in Stock Investments

Diversification is a key strategy in mitigating risks when investing in stocks. By spreading your investments across different industries, sectors, and asset classes, you can reduce the impact of any single investment underperforming. This way, if one sector experiences a downturn, your overall portfolio may be less affected. It is important to regularly review and adjust your diversification strategy based on market conditions.

Impact of Economic Factors

Economic factors can have different impacts on real estate investments compared to stock investments. For real estate, factors such as interest rates, employment rates, and housing demand can greatly influence property values and rental income. On the other hand, stock investments are more directly impacted by factors like company performance, market volatility, and overall economic growth. Understanding these differences can help investors make more informed decisions in managing risks in both asset classes.