Diving into the world of financial markets basics opens up a realm of possibilities, where knowledge is power and opportunities abound. From understanding market structures to analyzing asset pricing, this guide will equip you with the essential knowledge needed to navigate the complex landscape of financial markets.

Get ready to explore the key concepts and components that drive the financial world, as we break down the fundamentals in a way that’s both informative and engaging.

Overview of Financial Markets

Financial markets are where individuals, businesses, and governments come together to trade financial assets such as stocks, bonds, commodities, and currencies. These markets play a crucial role in determining prices, allocating capital, and transferring risk in the economy.

Types of Financial Markets

- Stock Market: Where shares of publicly traded companies are bought and sold.

- Bond Market: Where debt securities are issued and traded.

- Commodity Market: Where raw materials like gold, oil, and agricultural products are traded.

- Foreign Exchange Market: Where different currencies are bought and sold.

Role of Financial Markets in the Economy

Financial markets help facilitate the flow of funds between savers and borrowers, allowing businesses to raise capital for investments and individuals to save for the future. They also provide liquidity, price discovery, and risk management mechanisms that contribute to overall economic growth and stability.

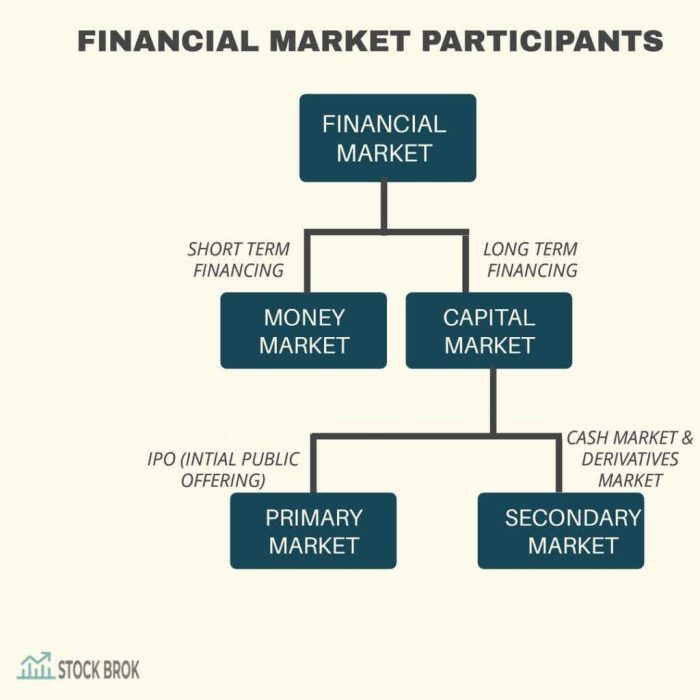

Participants in Financial Markets

Financial markets are made up of various key participants who play different roles in the buying and selling of financial assets. These participants include investors, issuers, brokers, and regulators.

Investors

- Investors are individuals or institutions that buy and sell financial assets in the market.

- They can be classified into two main categories: institutional investors and retail investors.

- Institutional investors are large entities such as pension funds, mutual funds, and insurance companies that invest on behalf of others.

- Retail investors are individual investors who trade with their personal funds.

Issuers

- Issuers are entities that issue financial securities to raise capital.

- They can be governments, corporations, or other organizations looking to raise funds through debt or equity offerings.

- Issuers play a crucial role in providing investment opportunities for investors in the market.

Brokers

- Brokers act as intermediaries between buyers and sellers in the financial markets.

- They facilitate the buying and selling of securities on behalf of their clients.

- Brokers earn commissions or fees for their services in executing trades.

Regulators

- Regulators are government agencies responsible for overseeing and regulating financial markets to ensure transparency, fairness, and investor protection.

- They enforce rules and regulations to maintain the integrity of the market and prevent fraud or misconduct.

- Regulators play a critical role in maintaining market stability and investor confidence.

Types of Financial Instruments

Financial instruments play a crucial role in the functioning of financial markets. These instruments represent a claim on the future cash flows or assets of an entity. Let’s explore some common types of financial instruments and their risk-return profiles.

Stocks

Stocks, also known as equities, represent ownership in a company. When you buy a stock, you become a shareholder and have a claim on the company’s assets and earnings. Stocks are considered one of the riskiest financial instruments but also offer the potential for high returns. The value of a stock can fluctuate based on the performance of the company and overall market conditions.

Bonds

Bonds are debt instruments issued by governments, municipalities, or corporations to raise capital. When you buy a bond, you are essentially lending money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity. Bonds are generally considered less risky than stocks but offer lower returns. The risk-return profile of bonds depends on factors such as the creditworthiness of the issuer and prevailing interest rates.

Derivatives

Derivatives are financial instruments whose value is derived from an underlying asset, index, or rate. Common types of derivatives include futures, options, and swaps. Derivatives are used for hedging, speculation, and arbitrage purposes. These instruments can be highly complex and carry significant risk. The risk-return profile of derivatives varies depending on the type of derivative and the underlying asset.

Market Structure and Trading

Financial markets are structured in a way that allows participants to buy and sell various financial instruments such as stocks, bonds, and commodities. These markets can be divided into primary markets where new securities are issued, and secondary markets where existing securities are traded among investors.

Trading Process in Financial Markets

Trading securities in financial markets involves a series of steps that ensure the smooth exchange of assets between buyers and sellers. Here is a breakdown of the trading process:

- Order Placement: Investors place orders to buy or sell securities through brokers or electronic trading platforms.

- Order Matching: Orders are matched based on price and quantity, with electronic systems executing trades automatically.

- Trade Confirmation: Once a trade is executed, investors receive a confirmation detailing the transaction.

- Settlement: The final step involves settling the trade by transferring ownership of the securities and funds between parties.

Impact of Technology on Modern Financial Market Trading

Technology has revolutionized the way financial markets operate, making trading faster, more efficient, and accessible to a wider range of participants. Here are some key ways technology has impacted modern financial market trading:

- High-Frequency Trading: Algorithms and computer systems enable high-speed trading, executing thousands of orders in milliseconds.

- Electronic Trading Platforms: Online platforms allow investors to trade securities from anywhere in the world, increasing market liquidity.

- Data Analysis: Advanced analytics tools help traders make informed decisions based on market trends and patterns.

- Risk Management: Technology provides real-time monitoring of market risks, helping investors mitigate potential losses.

Market Efficiency and Pricing

In the world of financial markets, market efficiency and pricing play a crucial role in determining the value of assets and securities. Market efficiency refers to how quickly and accurately prices of assets reflect all available information. Let’s dive deeper into this concept.

Forms of Market Efficiency

Market efficiency can be classified into three forms: weak, semi-strong, and strong.

- Weak Form Efficiency: In this form, asset prices reflect all past market data, such as historical prices and trading volumes. Technical analysis is commonly used in weak form efficiency to predict future price movements.

- Semi-Strong Form Efficiency: This form includes all information in weak form efficiency, as well as all publicly available information. This means that fundamental analysis, along with technical analysis, is used to make investment decisions.

- Strong Form Efficiency: The strongest form of market efficiency, where asset prices reflect all information, both public and private. In this form, even insider information cannot be used to gain an advantage in the market.

Market efficiency is a key concept in finance, as it determines how quickly and accurately asset prices adjust to new information.

Factors Influencing Asset Pricing

Various factors influence asset pricing in financial markets. These include:

| Factor | Description |

|---|---|

| Interest Rates | Changes in interest rates can affect the value of assets, such as bonds and stocks. |

| Economic Indicators | Reports on economic data, such as GDP growth, inflation rates, and unemployment, can impact asset prices. |

| Market Sentiment | Investor perceptions and emotions can influence buying and selling decisions, leading to price fluctuations. |

| Company Performance | Financial results and news related to a company can directly affect the value of its stock. |

Asset pricing is a complex process influenced by a wide range of factors, making it essential for investors to stay informed and analyze market conditions carefully.

Fundamental Analysis vs. Technical Analysis

Fundamental analysis and technical analysis are two primary methods used by investors and traders to evaluate securities in financial markets. While fundamental analysis focuses on the intrinsic value of an asset based on economic, financial, and qualitative factors, technical analysis looks at past market data and price trends to predict future price movements.

Fundamental Analysis

Fundamental analysis involves evaluating a company’s financial health, including its revenues, earnings, assets, and liabilities, to determine its true value. Analysts assess factors such as industry trends, competitive positioning, and macroeconomic conditions to make investment decisions. By analyzing financial statements, economic indicators, and market trends, fundamental analysis aims to identify undervalued or overvalued assets.

- Examines financial statements and economic indicators

- Considers qualitative factors such as management team and industry trends

- Focuses on long-term investment opportunities

Technical Analysis

Technical analysis, on the other hand, relies on historical price charts and trading volumes to forecast future price movements. Traders use various technical indicators and chart patterns to identify trends and patterns that can help them make buy or sell decisions. This approach assumes that historical price movements can provide insights into future market behavior.

- Utilizes charts, graphs, and technical indicators

- Focuses on short-term price movements and trends

- Does not consider underlying fundamentals of the asset

Comparison and Contrast

Fundamental analysis and technical analysis differ in their approaches to evaluating securities. While fundamental analysis focuses on the intrinsic value of an asset and long-term investment opportunities, technical analysis relies on historical price data to predict short-term price movements. Fundamental analysis considers economic, financial, and qualitative factors, while technical analysis focuses solely on price charts and trading volumes. Both methods have their strengths and weaknesses, and some investors use a combination of both approaches to make well-informed investment decisions.