Tax planning strategies set the foundation for a smart financial future, revealing a world of possibilities to navigate the complex realm of taxes with finesse. Get ready to explore the ins and outs of tax planning like never before, with a touch of American high school hip style that keeps you hooked from the get-go.

As we delve deeper into the various aspects of tax planning, you’ll uncover valuable insights and expert tips to help you make the most of your financial resources.

Overview of Tax Planning Strategies

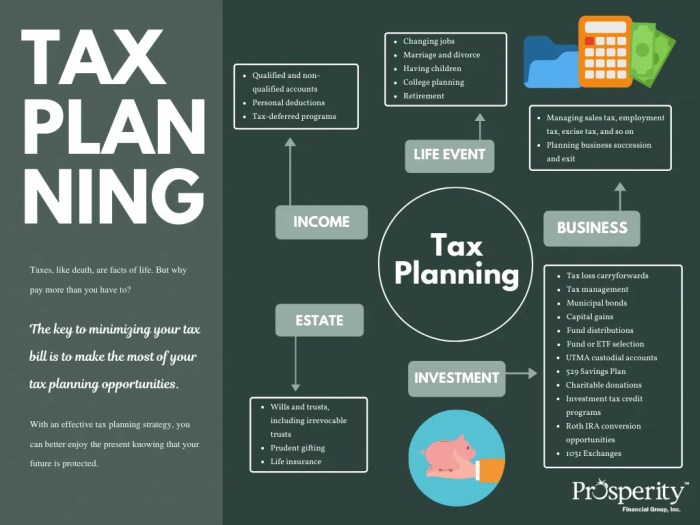

Tax planning strategies are essential for individuals and businesses to optimize their financial situation by minimizing tax liabilities. By strategically planning how income, expenses, and investments are managed, taxpayers can legally reduce the amount of taxes they owe to the government.

Key Elements of Tax Planning

- Income Management: Structuring income sources to minimize tax obligations.

- Deductions and Credits: Utilizing deductions and credits to reduce taxable income.

- Investment Planning: Choosing tax-efficient investment options to maximize returns.

- Risk Management: Assessing potential tax risks and implementing strategies to mitigate them.

Benefits of Effective Tax Planning Strategies

- Cost Savings: Lowering tax liabilities means more money in your pocket for other expenses or investments.

- Compliance: Ensuring that tax obligations are met while taking advantage of available deductions and credits.

- Financial Security: Protecting assets and wealth through strategic tax planning measures.

- Long-Term Planning: Creating a roadmap for future financial goals and minimizing tax implications along the way.

Types of Tax Planning Strategies

Tax planning strategies can be categorized into short-term and long-term approaches, each with its own benefits and considerations.

Short-Term Tax Planning Strategies

Short-term tax planning strategies focus on minimizing tax liability within the current financial year. Some examples include:

- Accelerating deductions by prepaying expenses

- Deferring income to the next year

- Claiming tax credits for eligible expenses

Long-Term Tax Planning Strategies

Long-term tax planning strategies involve planning for the future to reduce overall tax burden and maximize savings. These strategies often include:

- Investing in tax-deferred retirement accounts

- Utilizing tax-efficient investment strategies

- Estate planning to minimize estate taxes for heirs

Long-term strategies offer the advantage of building wealth over time through tax-efficient investments and minimizing tax impact on future financial goals.

Proactive vs. Reactive Tax Planning Approaches

Proactive tax planning involves anticipating tax implications and taking steps to minimize taxes before they occur. This approach allows individuals to plan ahead and take advantage of available deductions and credits.

On the other hand, reactive tax planning involves responding to tax situations as they arise, often resulting in missed opportunities for tax savings. It is important to be proactive in tax planning to maximize benefits and minimize tax liabilities.

Tax Saving Investments

Investing in tax-efficient options can help you minimize your tax liability while growing your wealth. By strategically diversifying your investments, you can take advantage of various tax benefits and save money in the long run.

Individual Retirement Accounts (IRAs)

IRA contributions are tax-deductible, allowing you to reduce your taxable income for the year. Additionally, your investments can grow tax-deferred until you start making withdrawals in retirement. Traditional IRAs offer immediate tax benefits, while Roth IRAs provide tax-free growth and withdrawals in retirement.

401(k) Retirement Plans

401(k) plans are popular retirement savings vehicles offered by employers. Contributions to a traditional 401(k) are made with pre-tax dollars, reducing your taxable income. Employers may also match a portion of your contributions, further enhancing your savings. Roth 401(k) options are available as well, providing tax-free withdrawals in retirement.

Mutual Funds with Tax Efficiency

Mutual funds can be tax-efficient when managed properly. Look for funds with low turnover rates to minimize capital gains taxes. Additionally, consider investing in index funds or ETFs that typically have lower tax implications compared to actively managed funds.

Strategic Use of Deductions and Credits

When it comes to tax planning, utilizing deductions and credits strategically can make a significant impact on reducing your tax liability. Deductions and credits are valuable tools that can help individuals and businesses optimize their tax planning strategies.

Common Deductions and Credits

- Common deductions for individuals include mortgage interest, medical expenses, charitable contributions, and state and local taxes.

- Businesses can often deduct expenses such as salaries, rent, utilities, and supplies.

Understanding Tax Credits

- Tax credits differ from deductions in that they directly reduce the amount of tax owed, rather than reducing taxable income.

- Examples of tax credits include the Child Tax Credit, Earned Income Tax Credit, and Education Tax Credits.

Optimizing Tax Planning with Deductions and Credits

- By taking advantage of deductions and credits, individuals can lower their taxable income and reduce their overall tax burden.

- Businesses can maximize their tax savings by properly documenting and claiming eligible expenses and credits.

Retirement Planning and Tax Efficiency

Retirement planning plays a crucial role in tax efficiency as it allows individuals to strategically manage their income and investments to minimize tax liabilities during retirement. By understanding how retirement accounts are taxed and utilizing specific strategies, individuals can maximize their savings and reduce their tax burden.

Maximizing Tax Efficiency in Retirement Accounts

- One effective strategy is to contribute to tax-advantaged retirement accounts such as 401(k)s, IRAs, or Roth IRAs. These accounts offer tax benefits either on contributions or withdrawals, allowing individuals to grow their retirement savings tax-free or tax-deferred.

- Another strategy is to consider the timing of withdrawals from retirement accounts. By carefully planning when to take distributions, individuals can manage their taxable income in retirement and potentially lower their overall tax rate.

- Utilizing catch-up contributions for individuals over 50 can also increase retirement savings while benefiting from additional tax advantages.

Impact of Early Withdrawals and Required Minimum Distributions

- Early withdrawals from retirement accounts before the age of 59 ½ may result in penalties and taxes, impacting both the individual’s savings and tax liabilities.

- Required Minimum Distributions (RMDs) from traditional retirement accounts must be taken starting at age 72. Failing to withdraw the required amount can lead to significant penalties, affecting the individual’s tax situation.

- Proper planning for RMDs, including considering qualified charitable distributions or converting traditional IRAs to Roth IRAs, can help minimize the tax impact of these distributions.