Dive into the world of Asset allocation strategies, where savvy investors navigate the complex landscape of investments with precision and foresight. Understanding the importance of strategic asset allocation is the key to unlocking the potential for maximizing returns while managing risks effectively. Let’s explore the art and science behind crafting a well-balanced portfolio that aligns with your financial goals and risk tolerance.

Introduction to Asset Allocation Strategies

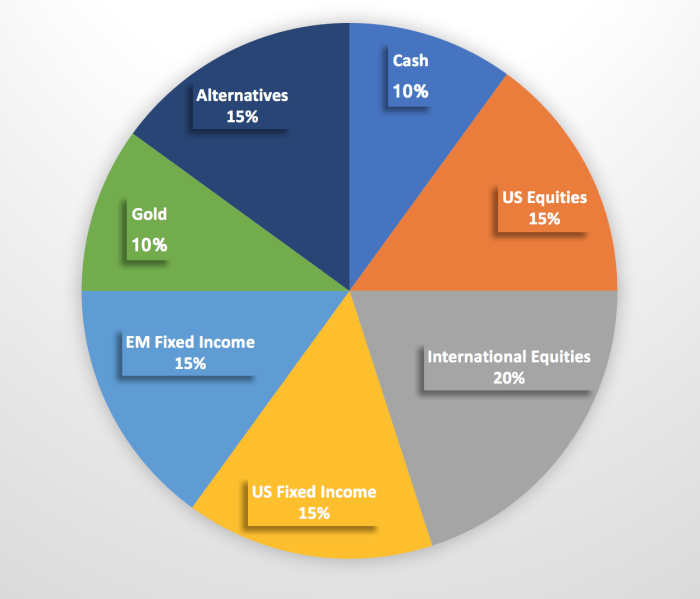

Asset allocation strategies refer to the process of distributing your investments across different asset classes such as stocks, bonds, real estate, and cash to achieve your financial goals while managing risk. It is a crucial component of any investment plan as it helps in diversifying your portfolio and optimizing returns.

Having a well-thought-out asset allocation plan can provide several benefits. Firstly, it helps in reducing the overall risk of your investment portfolio by spreading your money across different asset classes. This diversification helps in lowering the impact of market volatility on your investments. Secondly, it allows you to capitalize on the potential returns of different asset classes, ensuring that you have exposure to various investment opportunities. Lastly, a strategic asset allocation plan can help you stay focused on your long-term financial objectives and avoid making impulsive investment decisions based on short-term market movements.

Examples of different asset classes that can be part of an allocation strategy include:

– Equities: Stocks of publicly traded companies that offer the potential for high returns but come with higher risk.

– Fixed Income: Bonds and other debt securities that provide a steady stream of income with lower risk compared to equities.

– Real Estate: Investments in physical properties or real estate investment trusts (REITs) that can generate rental income and capital appreciation.

– Cash and Cash Equivalents: Liquid assets like savings accounts, certificates of deposit (CDs), and money market funds that provide stability and liquidity to your portfolio.

Types of Asset Allocation Strategies

- Strategic Asset Allocation: A long-term approach that involves setting target allocations for different asset classes and periodically rebalancing to maintain those targets.

- Tactical Asset Allocation: A more active approach that involves making short-term adjustments to your asset allocation based on market conditions or economic outlook.

- Dynamic Asset Allocation: A flexible approach that allows for changes in asset allocation based on changing market conditions or personal financial goals.

Types of Asset Allocation Strategies

When it comes to asset allocation strategies, there are various approaches that investors can consider. Let’s take a look at the different types and their characteristics.

Strategic Asset Allocation

Strategic asset allocation involves setting target allocations and sticking to them for the long term. This approach relies on the belief that different asset classes perform differently under various market conditions.

- Characteristics:

- Passive approach

- Long-term perspective

- Rebalancing at set intervals

Example: A young investor with a long investment horizon may opt for strategic asset allocation to benefit from long-term growth potential.

Tactical Asset Allocation

Tactical asset allocation involves making short-term adjustments to the portfolio based on market conditions or economic forecasts. This strategy aims to capitalize on short-term opportunities.

- Characteristics:

- Active approach

- Short-term focus

- Flexibility to adjust allocations

Example: An investor who wants to take advantage of short-term market trends may choose tactical asset allocation to maximize returns.

Dynamic Asset Allocation

Dynamic asset allocation involves actively managing the portfolio based on changing market conditions. This strategy allows for more frequent adjustments to allocations.

- Characteristics:

- Active approach

- Responsive to market changes

- Opportunistic in nature

Example: A seasoned investor who closely monitors market movements may prefer dynamic asset allocation to react quickly to changing conditions.

Constant-Weighting Asset Allocation

Constant-weighting asset allocation involves maintaining fixed percentages for each asset class regardless of market conditions. This strategy requires regular rebalancing to maintain the target allocations.

- Characteristics:

- Fixed allocation percentages

- Regular rebalancing

- Stable asset mix

Example: An investor seeking a more stable and predictable portfolio may opt for constant-weighting asset allocation to maintain consistent exposure to different asset classes.

Factors Influencing Asset Allocation Decisions

When it comes to making decisions about asset allocation, there are several key factors that investors need to consider. These factors play a crucial role in determining the overall investment strategy and can have a significant impact on the success of the portfolio.

Risk Tolerance:

One of the most important factors to consider when deciding on asset allocation is risk tolerance. This refers to the level of risk that an investor is comfortable with and willing to take on. Investors with a higher risk tolerance may choose to allocate a larger portion of their portfolio to riskier assets, such as stocks, while those with a lower risk tolerance may prefer safer options like bonds or cash.

Investment Goals:

Another key factor to consider is investment goals. Different investors have different objectives when it comes to investing, whether it be saving for retirement, buying a house, or funding a child’s education. These goals will influence the asset allocation strategy, as the investment mix should be aligned with the time horizon and expected returns needed to achieve these goals.

Time Horizon:

The time horizon is also an important consideration in asset allocation decisions. Investors with a longer time horizon may be able to take on more risk in their portfolio, as they have more time to weather market fluctuations and benefit from the potential growth of riskier assets. On the other hand, investors with a shorter time horizon may need to prioritize capital preservation and opt for more conservative investments.

Market Conditions:

Finally, market conditions can impact asset allocation decisions. Economic indicators, market trends, and geopolitical events can all affect the performance of different asset classes. Investors need to stay informed and adapt their asset allocation strategy accordingly to capitalize on opportunities and mitigate risks in changing market environments.

Diversification:

Diversification plays a crucial role in asset allocation by spreading investments across different asset classes, industries, and geographic regions. This helps reduce the overall risk of the portfolio, as losses in one asset class may be offset by gains in another. Diversification can provide a smoother ride for investors and improve the risk-return profile of the portfolio.

Implementation of Asset Allocation Strategies

When it comes to implementing asset allocation strategies, there are several key steps to consider. It’s essential to have a clear plan in place before making any investment decisions.

Creating an Asset Allocation Plan

- Define your investment goals and risk tolerance.

- Identify suitable asset classes based on your goals and risk profile.

- Determine the target allocation percentages for each asset class.

- Select specific investments within each asset class.

Importance of Periodic Review and Rebalancing

Periodic review and rebalancing are crucial to ensure that your asset allocation remains aligned with your goals and risk tolerance.

- Regularly review your portfolio performance and adjust as needed.

- Rebalance your portfolio by buying and selling assets to maintain your target allocation percentages.

- Consider rebalancing at least annually or when your allocation drifts significantly from the targets.

Adjusting Asset Allocation Based on Market Conditions

Market conditions can impact the performance of your investments, requiring adjustments to your asset allocation strategy.

- Monitor market trends and economic indicators to gauge potential risks and opportunities.

- Consider shifting allocations based on changing market conditions, such as economic downturns or inflation concerns.

- Consult with a financial advisor to get insights on adjusting your asset allocation to navigate market fluctuations.