Financial metrics for startups sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Whether you’re a budding entrepreneur or a seasoned business owner, understanding the ins and outs of financial metrics is crucial for navigating the competitive startup landscape. This guide will delve into the importance of financial metrics, revenue metrics, cost metrics, cash flow management, and growth metrics, providing you with the tools you need to drive your startup towards success.

Importance of Financial Metrics

Financial metrics play a crucial role in the success of startups by providing valuable insights into the financial health and performance of the business. These metrics help startups in making informed decisions, identifying areas of improvement, and tracking progress towards their goals.

Key Financial Metrics for Startups

- Cash Burn Rate: This metric measures how quickly a startup is using up its available cash. It helps in determining the runway of the business and whether adjustments need to be made to sustain operations.

- Customer Acquisition Cost (CAC): CAC allows startups to understand how much it costs to acquire a new customer. By comparing this metric to the lifetime value of a customer, startups can assess the effectiveness of their marketing and sales strategies.

- Monthly Recurring Revenue (MRR): MRR is a key metric for subscription-based startups as it indicates the predictable revenue generated each month. It helps in forecasting future revenue and evaluating the growth trajectory of the business.

- Gross Margin: Gross margin shows the percentage of revenue that exceeds the cost of goods sold. Startups can use this metric to analyze the profitability of their products or services and make pricing decisions accordingly.

- Churn Rate: Churn rate measures the percentage of customers who stop using a product or service within a given period. By tracking this metric, startups can identify factors leading to customer attrition and implement strategies to improve retention.

Revenue Metrics

Revenue metrics are essential for startups to track as they provide valuable insights into the financial health and performance of the business. By analyzing revenue metrics, startups can make informed decisions that drive growth and profitability.

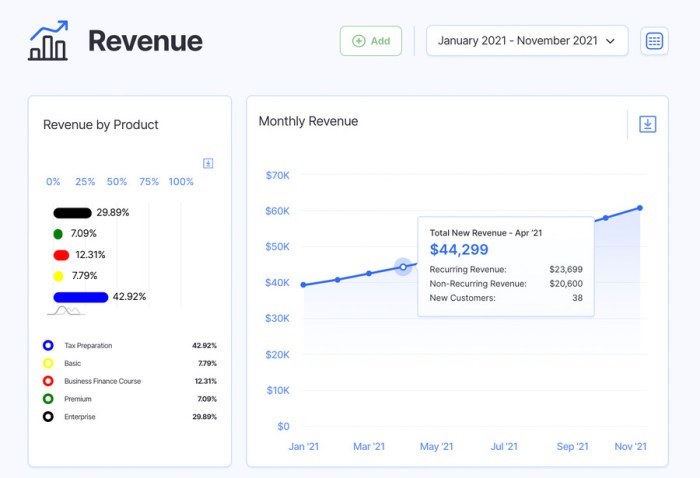

One of the important revenue metrics that startups should track is Monthly Recurring Revenue (MRR). MRR represents the predictable revenue that a company expects to receive each month from subscriptions or recurring services. Tracking MRR allows startups to monitor their revenue streams and identify trends over time.

Another crucial revenue metric is Customer Lifetime Value (CLTV). CLTV measures the total revenue that a business can expect to generate from a single customer over the course of their relationship. By understanding CLTV, startups can focus on acquiring high-value customers and optimize their marketing and sales strategies accordingly.

Average Revenue Per User (ARPU)

Average Revenue Per User (ARPU) is a metric that calculates the average revenue generated by each customer or user of a product or service. It is calculated by dividing the total revenue generated by the number of active users. ARPU helps startups gauge the effectiveness of their pricing strategies and identify opportunities to increase revenue per customer.

Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) is the total cost incurred by a startup to acquire a new customer. This metric is crucial for startups to evaluate the efficiency of their marketing and sales efforts. By comparing CAC to CLTV, startups can determine the return on investment for acquiring new customers and adjust their customer acquisition strategies accordingly.

Revenue Growth Rate

Revenue Growth Rate measures the percentage increase or decrease in revenue over a specific period. This metric is essential for startups to assess their growth trajectory and set realistic revenue targets. By tracking revenue growth rate, startups can make informed decisions about resource allocation, expansion strategies, and overall business development.

Cost Metrics

When it comes to running a startup, monitoring cost metrics is crucial for financial health and sustainability. By tracking key cost metrics, startups can identify areas where expenses can be optimized and controlled, ultimately leading to improved profitability.

Essential Cost Metrics

- Cash Burn Rate: This metric measures how quickly a startup is using up its available cash. It helps in determining the runway, which is the amount of time before the startup runs out of cash.

- Customer Acquisition Cost (CAC): CAC calculates how much it costs to acquire a new customer. By monitoring this metric, startups can evaluate the effectiveness of their marketing and sales efforts.

- Operating Expenses: Tracking operating expenses, including rent, salaries, utilities, and other day-to-day costs, is essential for understanding the overall financial health of a startup.

Optimizing Expenses

- Vendor Negotiation: Startups can optimize expenses by negotiating better terms with vendors for supplies or services, reducing costs without compromising quality.

- Automation: Implementing automation tools can help streamline processes, reduce manual labor costs, and improve efficiency.

- Outsourcing: Outsourcing non-core functions can be a cost-effective way for startups to access specialized expertise without the need for full-time employees.

Cost Metrics and Profitability

Cost metrics directly impact the profitability of startups. By efficiently managing costs and optimizing expenses, startups can increase their profit margins and overall financial performance. Understanding the relationship between cost metrics and profitability is essential for long-term success and growth.

Cash Flow Management

Cash flow management is crucial for startups as it involves monitoring the flow of cash in and out of the business to ensure financial stability and sustainability.

Importance of Cash Flow Management

Effective cash flow management is essential for startups to cover operating expenses, pay debts, and invest in growth opportunities. By maintaining a positive cash flow, startups can avoid financial difficulties and ensure long-term success.

How Cash Flow Metrics Influence Financial Stability

- Cash flow metrics like operating cash flow ratio and free cash flow help startups evaluate their ability to generate cash to meet financial obligations.

- By analyzing cash flow metrics, startups can identify potential cash shortages and take proactive measures to address them, preventing cash flow problems that could lead to insolvency.

- Monitoring cash flow metrics also provides insights into the overall financial health of the business, allowing startups to make informed decisions and adjustments to improve financial stability.

Strategies for Improving Cash Flow

- Implementing efficient billing and collection processes to accelerate cash inflows.

- Reducing unnecessary expenses and managing inventory levels to control cash outflows.

- Negotiating favorable payment terms with suppliers and customers to optimize cash flow.

- Regularly reviewing and analyzing cash flow statements to identify trends and areas for improvement.

Growth Metrics

When it comes to measuring the success and potential of a startup, focusing on key growth metrics is crucial. These metrics provide valuable insights into how the business is progressing and where improvements can be made to scale effectively.

Key Growth Metrics for Startups

- Monthly Recurring Revenue (MRR): This metric tracks the predictable revenue generated by the startup on a monthly basis, indicating the growth and stability of the business.

- Customer Acquisition Cost (CAC): CAC helps startups understand how much it costs to acquire a new customer, ensuring that the cost of acquiring customers is sustainable.

- Churn Rate: Churn rate measures the percentage of customers who stop using the startup’s product or service, highlighting the effectiveness of customer retention strategies.

Indicators of Success

Growth metrics serve as indicators of success for startups by providing actionable data that can drive strategic decisions. By analyzing these metrics, startups can identify areas of improvement, capitalize on opportunities for growth, and make informed decisions to scale their business effectively.

Examples of Growth Metrics for Scaling

| Metric | Description |

|---|---|

| Customer Lifetime Value (CLV) | CLV helps startups understand the value a customer brings to the business over their entire relationship, guiding decisions on customer acquisition and retention strategies. |

| Product Engagement Metrics | Metrics like daily active users, session duration, and feature adoption rate provide insights into how customers interact with the product, enabling startups to enhance user experience and drive growth. |