Annuities explained sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Whether you’re a finance novice or a seasoned investor, understanding the ins and outs of annuities is essential for securing your financial future.

Annuities Overview

An annuity is a financial product that provides a series of payments made at equal intervals. It is typically used as a tool for retirement planning to ensure a steady income stream after retirement.

Types of Annuities

- Fixed Annuities: These annuities offer a guaranteed payout amount over a specific period of time.

- Variable Annuities: These annuities allow the holder to invest in different sub-accounts, with the payout amount depending on the performance of the investments.

- Indexed Annuities: These annuities tie the interest rate to a specific market index, offering the potential for higher returns.

Purpose of Annuities in Financial Planning

Annuities are commonly used in financial planning to provide a reliable income stream during retirement. They offer a sense of security by ensuring a steady flow of payments, regardless of market fluctuations. Additionally, annuities can be tailored to individual needs and goals, providing flexibility in terms of payment options and payout structures.

How Annuities Work

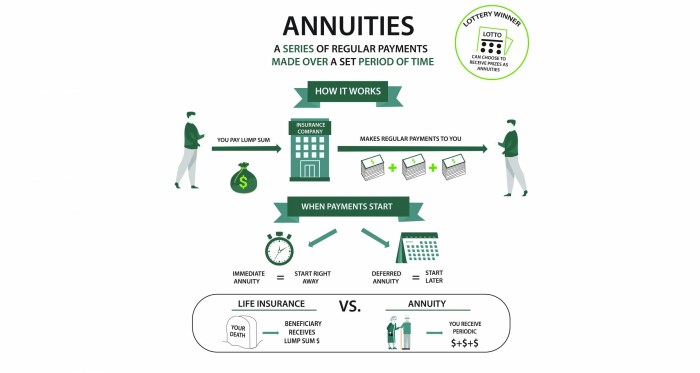

An annuity is a financial product that provides a series of payments to the annuitant over a set period of time. Let’s dive into how annuities work and the key players involved in the process.

Setting Up an Annuity

When setting up an annuity, an individual (annuitant) enters into a contract with an insurance company or financial institution (annuity provider). The annuitant makes either a lump-sum payment or a series of payments to the annuity provider. In return, the annuitant will receive regular payments, either immediately or at a future date, known as the distribution phase.

Role of Annuitants, Annuity Providers, and Beneficiaries

– Annuitant: The individual who receives the annuity payments. They are usually the owner of the annuity contract.

– Annuity Provider: The insurance company or financial institution that issues the annuity and guarantees the payments to the annuitant.

– Beneficiary: In the event of the annuitant’s death, the beneficiary will receive any remaining payments or a lump-sum amount, depending on the type of annuity contract.

Tax Implications of Annuities

- Contributions to an annuity are typically made with after-tax dollars, meaning they are not tax-deductible.

- However, the earnings on an annuity grow tax-deferred until withdrawn, at which point they are taxed as ordinary income.

- Early withdrawals before the age of 59 ½ may incur a 10% penalty in addition to income taxes.

- Upon the annuitant’s death, the beneficiary may have to pay taxes on any remaining annuity payments received.

Types of Annuities

When it comes to annuities, there are several types to choose from, each with its own unique features and benefits. Let’s compare and contrast fixed, variable, and indexed annuities, as well as delve into the differences between immediate and deferred annuities.

Fixed Annuities

Fixed annuities offer a guaranteed interest rate for a specific period, providing a stable and predictable income stream. The principal amount is protected, making it a lower-risk option for individuals seeking steady growth.

Variable Annuities

Variable annuities allow investors to choose from a selection of investment options, such as mutual funds. The returns are not guaranteed and can fluctuate based on market performance, offering the potential for higher returns but also greater risk.

Indexed Annuities

Indexed annuities offer a unique blend of fixed and variable features. They provide a minimum guaranteed interest rate combined with the opportunity to earn additional interest based on the performance of an underlying market index, offering some growth potential while protecting against market downturns.

Immediate Annuities

Immediate annuities start providing payments shortly after the initial investment, offering a regular income stream that can begin within a year of purchase. This type of annuity is beneficial for individuals seeking immediate income, such as retirees.

Deferred Annuities

Deferred annuities delay payments until a later date, allowing the invested funds to grow over time. This type of annuity is suitable for individuals looking to build up their retirement savings gradually before transitioning to a payout phase in the future.

Annuity Payout Options

When it comes to annuities, there are various payout options available to annuity holders. These options determine how and when you will receive payments from your annuity. Let’s explore the different payout options and factors that influence the choice.

Lump-Sum Payouts

Lump-sum payouts involve receiving the entire value of your annuity in one payment. This can be a good option if you need a large sum of money for a specific purpose, such as buying a house or paying off debt. Keep in mind that taking a lump sum may have tax implications.

Periodic Payments

With periodic payments, you receive fixed amounts at regular intervals, such as monthly, quarterly, or annually. This option provides a steady income stream and can help you budget effectively. However, the amount you receive may be affected by factors like interest rates and the performance of the annuity.

Life-Contingent Payments

Life-contingent payments guarantee income for the rest of your life, no matter how long you live. This option can provide peace of mind by ensuring you won’t outlive your savings. However, the amount of each payment may be lower compared to other payout options.

Factors that influence the choice of payout option include your financial goals, risk tolerance, current financial situation, and overall retirement strategy. It’s essential to carefully consider these factors before deciding on the payout option that best suits your needs.

Annuity Fees and Charges

When considering annuities, it’s crucial to understand the various fees and charges associated with them. These costs can have a significant impact on your overall return on investment, so it’s essential to be aware of them before making a decision.

Common Fees Associated with Annuities

- Sales Load: This is a commission paid to the salesperson or agent who sells you the annuity.

- Management Fees: These are ongoing fees charged by the insurance company for managing your annuity.

- Mortality and Expense Risk Fees: These fees cover the insurance and administrative costs of the annuity.

- Surrender Charges: If you withdraw money from the annuity before a certain period, you may incur surrender charges.

Impact of Fees on Overall Return

High fees can eat into your returns over time, reducing the amount of money you ultimately receive from the annuity. It’s important to consider the impact of fees on your investment and choose an annuity with fees that align with your financial goals.

Tips to Minimize Fees

- Shop Around: Compare fees from different insurance companies to find a competitive offer.

- Avoid High-Commission Products: Look for annuities with low sales loads to minimize upfront costs.

- Consider Fee Structures: Understand how fees are charged (e.g., upfront, ongoing, or upon withdrawal) and choose a structure that works best for you.