Best ways to day trade forex successfully kicks off with a bang, offering insights into the world of profitable trading that will keep you hooked from start to finish. Get ready to dive into the strategies and skills needed to conquer the forex market like a pro.

Get ready to learn about the essential skills, best practices, and tools that will take your day trading game to the next level. It’s time to turn your trading dreams into reality.

Introduction to Day Trading Forex

Day trading forex involves buying and selling currency pairs within the same trading day to capitalize on small price movements. Traders aim to profit from volatility in the forex market by making quick decisions based on technical analysis and market trends.

Advantages and Risks of Day Trading Forex

- Advantages:

- High liquidity: The forex market is the most liquid market in the world, providing ample trading opportunities.

- Potential for high returns: With leverage, traders can amplify their gains from small price movements.

- Flexibility: Traders can trade at any time of the day, allowing for greater control over their trading activities.

- Risks:

- High volatility: The forex market can experience rapid price swings, leading to potential losses.

- Leverage risk: While leverage can amplify profits, it also increases the risk of significant losses if trades go against the trader.

- Emotional challenges: Day trading requires discipline and emotional control to avoid making impulsive decisions based on fear or greed.

Importance of Strategic Approach in Day Trading Forex

Having a strategic approach in day trading forex is crucial for long-term success. Traders need to develop a clear trading plan that includes risk management strategies, entry and exit rules, and consistent analysis of market conditions. By following a strategic approach, traders can minimize risks and increase their chances of profitability in the forex market.

Essential Skills for Successful Day Trading

To be successful in day trading forex, there are essential skills that traders need to develop. These skills include a combination of technical knowledge, analytical skills, and risk management strategies.

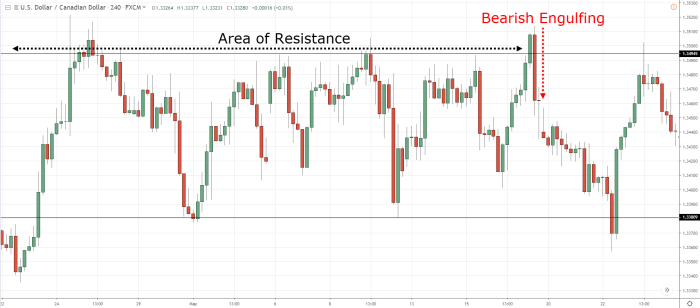

Technical Analysis in Day Trading Forex

Technical analysis plays a crucial role in day trading forex as it involves studying historical price charts to predict future price movements. Traders use various technical indicators and chart patterns to identify potential entry and exit points for their trades. Some common technical analysis tools used in day trading forex include moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Fibonacci retracement levels.

Risk Management Strategies for Day Trading Forex

Effective risk management is essential for day traders to protect their capital and minimize potential losses. Some risk management strategies that day traders can implement include setting stop-loss orders to limit losses on a trade, using proper position sizing to control the amount of capital at risk, diversifying their trading portfolio to spread risk, and avoiding emotional trading decisions. Additionally, maintaining a disciplined approach and adhering to a trading plan can help day traders manage risk effectively.

Best Practices for Day Trading Forex: Best Ways To Day Trade Forex Successfully

Day trading forex requires a combination of skills and strategies to be successful. Here are some best practices to keep in mind:

Choosing the Right Currency Pairs

When day trading forex, it is essential to choose the right currency pairs to focus on. Some pairs are more volatile and have higher trading volumes, making them ideal for day trading. Examples of popular currency pairs for day trading include EUR/USD, GBP/USD, and USD/JPY.

Setting Realistic Goals, Best ways to day trade forex successfully

Setting realistic goals is crucial in day trading forex. It is important to have a clear understanding of your risk tolerance, profit targets, and trading style. By setting achievable goals, you can stay focused and disciplined in your trading approach.

The Role of Discipline and Emotional Control

Discipline and emotional control play a significant role in successful day trading. It is essential to stick to your trading plan, follow your strategy, and avoid making impulsive decisions based on emotions. By maintaining discipline and controlling your emotions, you can improve your chances of success in day trading forex.

Tools and Resources for Day Traders

In the fast-paced world of day trading forex, having the right tools and resources at your disposal can make all the difference in your success. From trading platforms to economic calendars, each tool plays a crucial role in helping you make informed decisions and execute profitable trades.

Essential Tools for Day Traders

- Trading Platforms: Choose a reliable trading platform that offers real-time data, advanced charting tools, and fast execution speeds.

- Charting Software: Utilize charting software to analyze price movements, identify trends, and spot potential entry and exit points.

- News Sources: Stay informed by following reputable news sources that report on economic indicators, geopolitical events, and market news.

Using Economic Calendars and News Events

- Keep track of economic calendars to know when key economic indicators will be released, such as GDP, employment reports, and interest rate decisions.

- Pay attention to news events that can impact currency prices, such as geopolitical tensions, central bank statements, and trade agreements.

- Use this information to anticipate market reactions and adjust your trading strategy accordingly.

Significance of Demo Accounts

- Practice trading in a risk-free environment with demo accounts provided by many brokers.

- Develop and refine your trading skills without risking your capital.

- Test new strategies, learn how to manage risk, and gain confidence before trading with real money.