Kicking off with Comparing investment vehicles, this opening paragraph is designed to captivate and engage the readers with a breakdown of different investment options like stocks, bonds, mutual funds, and ETFs, and the risks associated with each. Get ready to dive into the world of investments!

Types of Investment Vehicles: Comparing Investment Vehicles

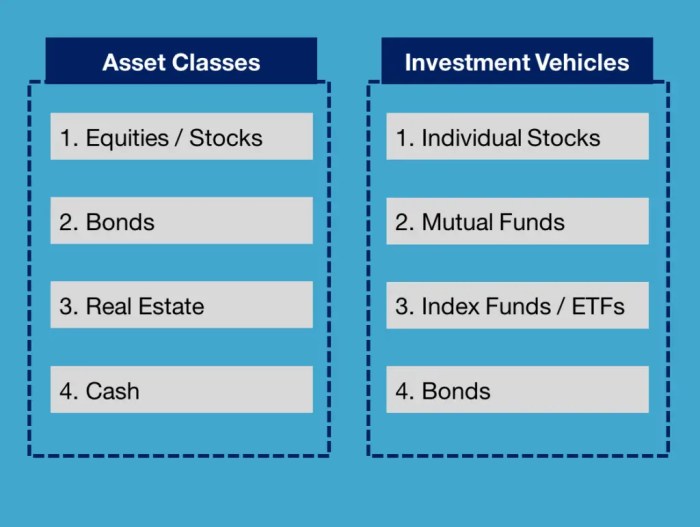

Investment vehicles are tools that allow individuals to invest their money in various financial assets to generate returns over time. There are several types of investment vehicles available in the market, each with its own unique features, benefits, and risks.

Stocks, Comparing investment vehicles

Stocks represent ownership in a company and are bought and sold on stock exchanges. Investors can earn money through dividends and capital appreciation. However, stocks are volatile and can be risky due to market fluctuations.

Bonds

Bonds are debt securities issued by governments or corporations to raise capital. Investors earn interest on bonds, making them a more stable investment compared to stocks. However, bond prices can fluctuate based on interest rates and credit risk.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They offer diversification and professional management but come with fees and expenses that can eat into returns.

Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They offer diversification, liquidity, and low costs compared to mutual funds. However, ETF prices can fluctuate throughout the trading day.Investors should carefully consider their risk tolerance, investment goals, and time horizon when choosing among these investment vehicles to create a well-balanced and diversified portfolio.

Factors to Consider When Choosing an Investment Vehicle

When it comes to choosing an investment vehicle, there are several key factors that investors need to consider to make informed decisions. These factors include risk tolerance, investment goals, liquidity, and time horizon.

Risk Tolerance

Risk tolerance plays a crucial role in selecting the right investment vehicle. This refers to an investor’s ability to withstand fluctuations in the value of their investments. Investors with a higher risk tolerance may be more comfortable investing in assets with greater volatility, such as stocks or cryptocurrencies. On the other hand, investors with a lower risk tolerance may prefer safer options like bonds or certificates of deposit.

Investment Goals

Investment goals are another important factor to consider when choosing an investment vehicle. Different investment vehicles are suited for different objectives, whether it’s long-term growth, income generation, capital preservation, or a combination of these goals. For example, stocks are often favored for long-term growth, while bonds are popular for generating income.

Liquidity and Time Horizon

Liquidity and time horizon also play a significant role in determining the appropriate investment vehicle. Liquidity refers to how quickly and easily an investment can be converted into cash without significantly impacting its value. Investors with short-term goals or needing quick access to their funds may prefer highly liquid investments like money market accounts. On the other hand, investors with a longer time horizon may opt for less liquid assets like real estate or retirement accounts.

Performance Metrics for Evaluating Investment Vehicles

When evaluating different investment vehicles, it is crucial to consider various performance metrics to assess their effectiveness in achieving financial goals. Key performance metrics such as ROI (Return on Investment), CAGR (Compound Annual Growth Rate), and Sharpe ratio play a vital role in comparing investment options and making informed decisions.

ROI (Return on Investment)

Return on Investment (ROI) is a fundamental performance metric that measures the profitability of an investment relative to its cost. It is calculated by dividing the net profit of an investment by the initial cost of the investment and expressing it as a percentage. A higher ROI indicates a more profitable investment.

CAGR (Compound Annual Growth Rate)

Compound Annual Growth Rate (CAGR) is another important metric used to evaluate the annual growth rate of an investment over a specified period. CAGR smoothens out the volatility in returns and provides a single growth rate over the investment period. It helps investors understand the true growth of their investments over time.

Sharpe Ratio

The Sharpe ratio is a risk-adjusted measure that evaluates the return of an investment relative to its risk. It considers the risk-free rate of return and the volatility of the investment to determine whether the returns are worth the risk taken. A higher Sharpe ratio indicates better risk-adjusted returns.Examples of how performance metrics help in assessing the effectiveness of an investment vehicle:

- If Investment A has an ROI of 15% and Investment B has an ROI of 10%, investors can conclude that Investment A is more profitable.

- Comparing the CAGR of two investments over a 5-year period can help investors identify which investment has shown more consistent growth over time.

- Analyzing the Sharpe ratio of different investment portfolios can assist investors in choosing investments that offer better risk-adjusted returns.

These performance metrics provide valuable insights into the profitability, growth potential, and risk levels associated with different investment vehicles, enabling investors to make well-informed decisions based on their financial objectives and risk tolerance.

Tax Implications of Different Investment Vehicles

Investing in different vehicles like stocks, bonds, and real estate can have varying tax implications that impact your overall returns.

Tax Advantages of Retirement Accounts vs. Taxable Investment Accounts

Retirement accounts such as 401(k) and IRA offer tax advantages that can help you save money in the long run. Contributions to these accounts are often tax-deductible, meaning you can reduce your taxable income for the year. Additionally, the earnings in these accounts can grow tax-deferred until you start making withdrawals in retirement. This allows your investments to compound without being subject to annual taxes on gains.On the other hand, taxable investment accounts do not offer the same tax benefits.

Any dividends, interest income, or capital gains generated from investments in these accounts are typically subject to taxes in the year they are earned. This can reduce your overall returns compared to retirement accounts where taxes are deferred.

Strategies to Minimize Tax Liabilities

One strategy to minimize tax liabilities when investing in different vehicles is to focus on tax-efficient investments. For example, investing in tax-exempt municipal bonds can help you generate income that is not subject to federal taxes. Another strategy is to hold investments for the long term to benefit from lower capital gains tax rates. By avoiding frequent buying and selling of assets, you can reduce the amount of short-term capital gains taxed at higher rates.It is also important to consider asset location when managing your investments.

Placing tax-inefficient investments like high-yield bonds or actively traded stocks in retirement accounts can help shield them from immediate taxes on gains. At the same time, holding tax-efficient investments like index funds or growth stocks in taxable accounts can minimize your tax burden.By implementing these strategies and being mindful of the tax implications of different investment vehicles, you can potentially optimize your investment returns and keep more of your money working for you in the long term.