Yo, dive into the world of compounding interest where your money can make more money just by chillin’. Let’s break it down and see how this financial magic works.

So, picture this – you stash away some cash and over time, it grows not just from the money you put in, but from the interest on top of that. Pretty cool, right?

What is Compounding Interest?

Compounding interest is a concept in finance where the interest that accrues on the principal amount of a loan or deposit is added to the principal, resulting in interest on interest. This process repeats over time, leading to exponential growth of the initial investment.

Unlike simple interest, which is calculated only on the principal amount, compounding interest takes into account both the principal and the accumulated interest. This means that the interest earned in one period is added to the principal for the next period, leading to higher returns over time.

Examples of Compounding Interest

Compounding interest can have a significant impact on the growth of investments. Let’s consider an example:

- Suppose you invest $1,000 in a savings account that offers an annual interest rate of 5%. At the end of the first year, you would earn $50 in interest, bringing the total amount to $1,050.

- In the second year, the interest is calculated not just on the initial $1,000 but on the new total of $1,050. This results in an interest of $52.50, bringing the total amount to $1,102.50.

- As this process continues over multiple years, the growth becomes more significant due to the compounding effect. Over time, your initial $1,000 investment can grow substantially with compounding interest.

Benefits of Compounding Interest

When it comes to investing for the long term, compounding interest can be a game-changer. This powerful concept allows your money to grow exponentially over time, thanks to the magic of reinvesting your earnings.

Advantages of Compounding Interest for Long-Term Investments

- As you reinvest your earnings, you earn interest on both your initial investment and the interest that has already been added to your account. This snowball effect can significantly boost your returns over time.

- Compounding interest helps to combat inflation by ensuring that your money keeps pace with the rising cost of living. This means that your savings retain their purchasing power and continue to grow steadily.

- By starting early and letting your investments compound over a long period, you can harness the power of time to build substantial wealth. Even small, regular contributions can grow into a sizable nest egg thanks to compounding.

Real-Life Scenarios of Wealth Accumulation through Compounding Interest

- Consider the case of an individual who starts investing $200 per month at the age of 25 and continues to do so for 40 years, earning an average annual return of 7%. By the time they reach 65, they could have over $500,000 in savings, with the majority of it coming from compounding interest.

- Another example is the story of a couple who consistently reinvested their dividends from stocks over several decades. Over time, the compounding effect turned their initial investment into a substantial portfolio worth millions of dollars.

- Whether through retirement accounts, mutual funds, or other investment vehicles, compounding interest has the potential to transform modest savings into a significant financial cushion for the future.

Factors Affecting Compounding Interest

When it comes to compounding interest, there are several key factors that can influence how your money grows over time. Understanding these factors is crucial in making informed decisions about your investments.

Frequency of Compounding

The frequency of compounding plays a significant role in determining the final amount of your investment. The more frequently interest is compounded, the faster your money will grow. For example, if you have an annual interest rate of 5% and interest is compounded quarterly, your investment will grow faster compared to if it were compounded annually.

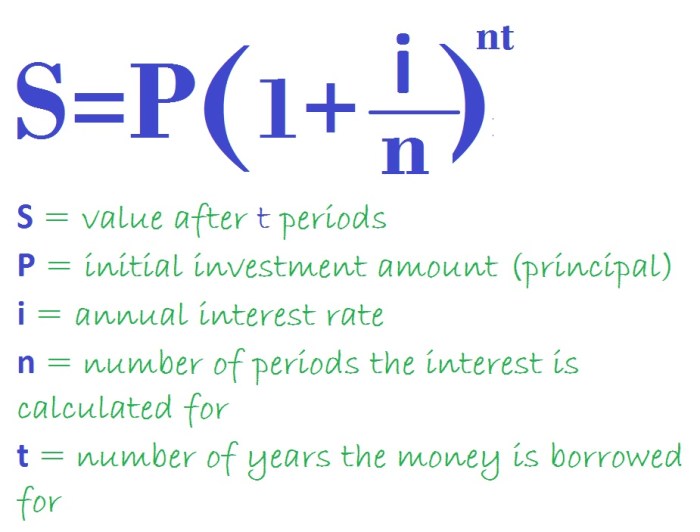

Compound interest formula: A = P(1 + r/n)^nt

- For example, if you invest $1,000 at an annual interest rate of 6% compounded quarterly for 5 years, the formula would look like this: A = $1,000(1 + 0.06/4)^(4*5)

- The more frequent compounding periods, the higher the final amount due to the effect of compounding on the principal and accumulated interest.

Impact of Interest Rates

Interest rates have a direct impact on the compounding process. Higher interest rates will result in a faster accumulation of wealth over time, while lower interest rates will lead to slower growth. It’s essential to consider the interest rate when choosing an investment option to maximize the compounding effect.

Higher interest rates lead to a higher final amount due to the exponential growth effect of compound interest.

- For instance, if you invest $500 at an annual interest rate of 8% compounded annually for 10 years, you will end up with more money compared to investing the same amount at a 4% interest rate.

- Choosing investments with higher interest rates can significantly impact your long-term financial goals.

Strategies for Maximizing Compounding Interest

When it comes to maximizing compounding interest, there are several strategies you can implement to boost your returns and achieve your financial goals faster. By understanding these strategies, you can make the most out of the power of compounding interest.

Start Early and Stay Consistent

One of the most effective strategies for maximizing compounding interest is to start investing early and stay consistent with your contributions. The earlier you start investing, the more time your money has to grow exponentially. By consistently contributing to your investment accounts, you can take advantage of compounding over a longer period, resulting in significant returns in the long run.

Reinvest Your Earnings

Another key strategy is to reinvest your earnings back into your investments. Instead of cashing out the interest or dividends you earn, reinvesting them allows you to compound your returns even further. This can accelerate the growth of your investment portfolio and help you reach your financial goals faster.

Increase Your Contributions Over Time

While starting early is crucial, increasing your contributions over time can also have a significant impact on your compounding interest returns. By gradually increasing the amount you invest, you can harness the power of compounding to grow your wealth at a faster rate. This strategy can help you maximize your returns and build a substantial nest egg for the future.