Customer Acquisition Cost sets the stage for businesses to understand the financial impact of acquiring new customers. From unraveling the formula to exploring successful strategies, this topic dives deep into the world of CAC with an engaging twist.

Get ready to discover the key elements that shape CAC and unveil the innovative approaches to lower costs while boosting customer acquisition.

Definition of Customer Acquisition Cost

Customer Acquisition Cost (CAC) is the total cost a business incurs to acquire a new customer. This metric is crucial for businesses as it helps them understand how much they need to invest in marketing and sales efforts to gain a customer, ultimately impacting profitability and growth.

Calculating CAC in Different Industries

- In the e-commerce industry, CAC can be calculated by dividing the total marketing and sales expenses by the number of new customers acquired within a specific time frame.

- For subscription-based businesses, CAC can be determined by dividing the total costs associated with acquiring customers (such as advertising, promotions, and sales team salaries) by the number of new subscribers gained.

- In the SaaS (Software as a Service) industry, CAC can be calculated by dividing the total sales and marketing costs by the number of new customers acquired through those efforts.

Significance of Understanding CAC for Business Growth

- By knowing the CAC, businesses can make informed decisions about their marketing and sales strategies, ensuring they invest resources where they are most effective in acquiring new customers.

- Understanding CAC also helps businesses evaluate the return on investment (ROI) of their customer acquisition efforts and identify areas for improvement to optimize their marketing spend.

- Furthermore, a low CAC relative to the customer lifetime value (LTV) indicates that a business is efficiently acquiring customers and has the potential for sustainable growth and profitability.

Factors Influencing Customer Acquisition Cost

When it comes to Customer Acquisition Cost (CAC), there are several factors that can significantly impact how much a business spends to acquire new customers. Understanding these factors is crucial for optimizing marketing strategies and maximizing ROI.

Competition

Competition plays a major role in determining CAC. In highly competitive industries, businesses may need to invest more in marketing and advertising to stand out and attract customers. This can drive up CAC as companies compete for the same target audience.

Marketing Channels

The choice of marketing channels also influences CAC. Different channels have varying costs associated with them, and the effectiveness of each channel in reaching and converting leads can impact overall CAC. For example, digital marketing channels like social media ads may have lower costs compared to traditional advertising methods like TV commercials.

Customer Demographics

Understanding the demographics of your target audience is essential for optimizing CAC. Different customer segments may respond differently to marketing campaigns, and tailoring strategies to specific demographics can help reduce CAC. For instance, targeting younger customers through social media platforms popular among that age group can lead to more cost-effective customer acquisition.

Successful Strategies for Reducing CAC

- Implementing referral programs to leverage existing customers and incentivize them to refer new customers.

- Improving customer retention rates to increase customer lifetime value and reduce the need for constant acquisition efforts.

- Utilizing data analytics to identify the most cost-effective marketing channels and optimize campaigns for better ROI.

- Personalizing marketing messages to resonate with different customer segments and improve conversion rates.

Calculating Customer Acquisition Cost

When it comes to running a business, understanding how to calculate Customer Acquisition Cost (CAC) is crucial for determining the effectiveness of your marketing strategies and allocating resources efficiently. CAC is the total cost a business incurs to acquire a new customer.

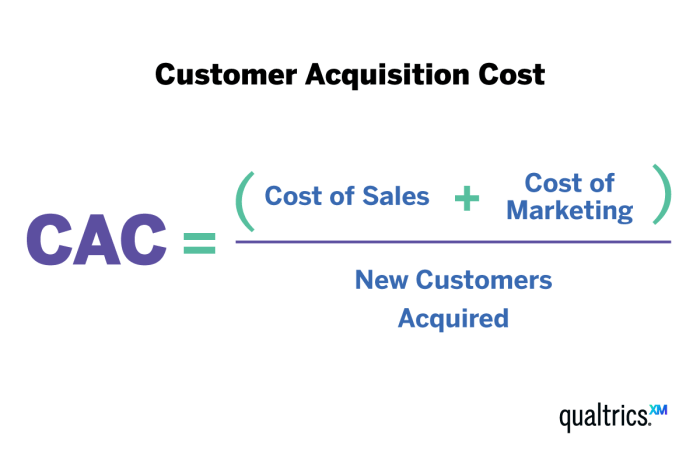

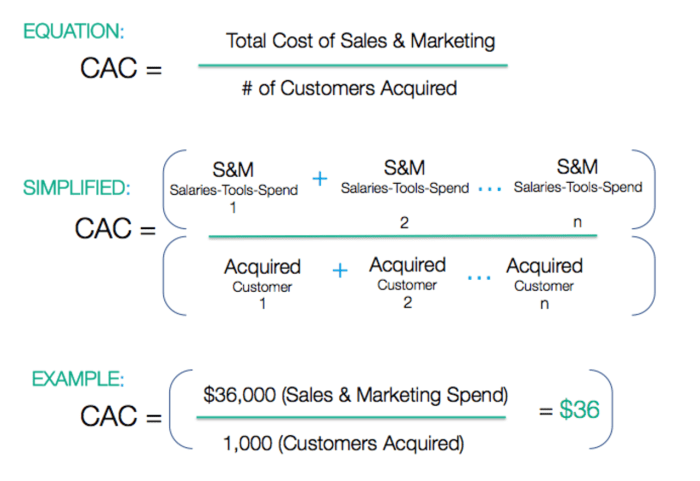

Formula for Calculating CAC

To calculate Customer Acquisition Cost, you can use the following formula:

CAC = (Total Marketing and Sales Expenses) / Number of New Customers Acquired

Step-by-Step Guide to Calculate CAC

- 1. Determine the total expenses incurred on marketing and sales activities within a specific period.

- 2. Count the number of new customers acquired during the same period.

- 3. Divide the total expenses by the number of new customers to get the Customer Acquisition Cost.

Comparison of Different Methods of Calculating CAC

- Simple CAC Calculation: This method divides total marketing and sales expenses by the number of new customers acquired. It provides a basic understanding of CAC but may oversimplify the actual costs involved.

- Adjusted CAC Calculation: Adjusting the CAC formula to include additional costs like overhead expenses or customer retention costs can provide a more accurate representation of the true cost of acquiring customers.

- Cohort-Based CAC Calculation: Analyzing CAC based on customer cohorts can help identify trends and variations in acquisition costs over time, providing insights for targeted marketing strategies.

Strategies to Lower Customer Acquisition Cost

Reducing Customer Acquisition Cost (CAC) is crucial for businesses to improve profitability and sustainability. Here are some innovative methods to lower CAC without compromising on customer acquisition:

Optimizing Digital Marketing Channels

By analyzing data from various digital marketing channels, businesses can identify the most effective channels for customer acquisition. This allows companies to allocate resources efficiently and reduce unnecessary spending on underperforming channels.

Implementing Referral Programs

Referral programs leverage existing customers to acquire new customers at a lower cost. By incentivizing referrals, businesses can tap into their loyal customer base to bring in new customers organically, decreasing the overall CAC.

Enhancing Customer Retention Strategies

Customer retention plays a vital role in lowering CAC as it costs less to retain existing customers than to acquire new ones. By focusing on delivering exceptional customer service and building strong relationships with customers, businesses can increase customer loyalty and reduce the need for constant acquisition efforts.

Utilizing Data Analytics for Targeted Marketing

By leveraging data analytics, businesses can create personalized and targeted marketing campaigns that resonate with their target audience. This approach increases the chances of acquiring customers who are more likely to convert, thereby lowering the overall CAC.

Real-World Examples:, Customer Acquisition Cost

Amazon reduced its CAC by implementing a seamless one-click ordering process, streamlining the customer journey and enhancing user experience.

Uber decreased its CAC by introducing referral programs that rewarded both existing and new users, encouraging word-of-mouth marketing and reducing acquisition costs.