Diving into the world of Financial tools for budgeting, this introduction sets the stage for exploring the ins and outs of managing your money like a boss. From budgeting apps to spreadsheet tools, get ready to level up your financial game with the latest tools and tricks.

Get ready to uncover the secrets to financial success and take control of your money with these powerful tools at your fingertips.

Overview of Financial Tools for Budgeting

Financial tools for budgeting are essential resources that help individuals manage their personal finances effectively. These tools assist in tracking income, expenses, savings, and investments to ensure financial stability and achieve financial goals. By utilizing financial tools for budgeting, individuals can gain better control over their money and make informed financial decisions.

Common Types of Financial Tools for Budgeting

- Spreadsheets: Programs like Microsoft Excel or Google Sheets are commonly used to create detailed budgets, track expenses, and analyze financial data.

- Personal Finance Apps: Mobile apps such as Mint, YNAB (You Need A Budget), and PocketGuard help users manage their finances on-the-go, set financial goals, and track spending.

- Online Budgeting Tools: Websites like EveryDollar and Personal Capital offer online platforms for budget creation, expense tracking, and investment management.

Benefits of Utilizing Financial Tools for Budgeting

- Improved Financial Awareness: Financial tools provide a clear overview of income, expenses, and savings, increasing awareness of one’s financial situation.

- Efficient Budget Management: These tools streamline the budgeting process, making it easier to allocate funds, track spending, and adjust financial goals.

- Goal Achievement: By using financial tools, individuals can set and monitor financial goals, such as saving for a vacation, purchasing a home, or building an emergency fund.

- Financial Security: Budgeting tools help individuals identify areas where they can save money, reduce unnecessary expenses, and build a strong financial foundation for the future.

Budgeting Apps

Budgeting apps are a popular tool for individuals looking to manage their finances effectively. These apps offer a convenient way to track expenses, set financial goals, and stay within budget. Let’s take a look at some popular budgeting apps available in the market and compare their features, usability, and cost.

Popular Budgeting Apps

- Mint: Mint is a free budgeting app that allows users to track their spending, create budgets, and receive personalized money-saving tips. It also provides a credit score monitoring feature.

- You Need a Budget (YNAB): YNAB is a subscription-based budgeting app that focuses on giving every dollar a job. It offers real-time syncing of bank accounts and helps users prioritize their spending.

- Personal Capital: Personal Capital is a comprehensive financial tool that not only helps with budgeting but also offers investment tracking and retirement planning services. It is free to use, with optional paid advisory services.

How Budgeting Apps Help

Using budgeting apps can help individuals in various ways, such as:

- Tracking Expenses: Budgeting apps allow users to categorize and track their expenses, making it easier to identify areas where they can cut back.

- Setting Financial Goals: These apps enable users to set specific financial goals, such as saving for a vacation or paying off debt. They provide visual representations of progress towards these goals.

- Automating Budgeting: By linking bank accounts to budgeting apps, users can automate the process of tracking income and expenses, saving time and reducing manual data entry errors.

Spreadsheet Tools

Using spreadsheet tools like Excel or Google Sheets for budgeting can be a game-changer when it comes to managing your finances. These tools offer a flexible and customizable way to track your income, expenses, and savings goals in one convenient place.

Setting up a Budgeting Spreadsheet

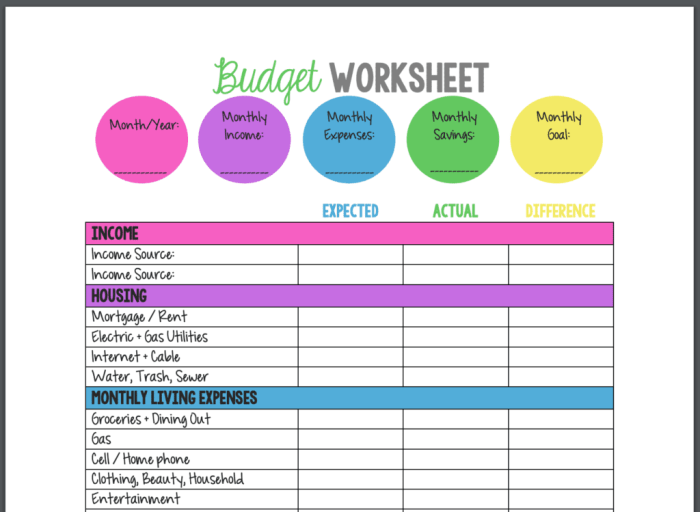

Setting up a budgeting spreadsheet effectively involves creating different categories for your income and expenses, inputting accurate data regularly, and using formulas to calculate totals automatically. Here are some tips to make the most out of your budgeting spreadsheet:

- Start by listing all your sources of income and fixed expenses.

- Break down variable expenses into categories like groceries, entertainment, and transportation.

- Use separate columns for each month to track changes in your spending habits over time.

- Include a section for savings goals and track your progress towards achieving them.

- Regularly update your spreadsheet with actual figures to compare against your budgeted amounts.

Advantages of Using Spreadsheet Tools for Budgeting

- Customization: You can tailor your spreadsheet to fit your unique financial situation and goals.

- Automation: Formulas can help you calculate totals, percentages, and variances with minimal effort.

- Visualization: Graphs and charts can provide a visual representation of your financial data for easier analysis.

- Accessibility: You can access your budgeting spreadsheet from any device with internet connection, making it convenient for on-the-go tracking.

Online Tools for Expense Tracking

When it comes to tracking expenses and creating budgets, online tools can be a game-changer. These tools are designed to simplify the process and provide real-time insights into your spending habits.

Key Features of Online Expense Tracking Tools

- Automatic Expense Categorization: Online tools can automatically categorize your expenses, saving you time and effort.

- Customizable Budgets: You can set specific budget categories and goals tailored to your financial needs.

- Real-Time Updates: Get instant updates on your spending and budget progress, helping you stay on track.

- Expense Notifications: Receive alerts and notifications when you exceed set budget limits to avoid overspending.

By utilizing online expense tracking tools, you can streamline your budgeting process and gain better control over your finances.

Automation and Real-Time Insights

- Automation: These tools can automate repetitive tasks like expense entry and calculation, saving you time and reducing errors.

- Real-Time Insights: With up-to-date data on your spending patterns, you can make informed decisions and adjust your budget as needed.

- Trend Analysis: Track trends in your spending over time to identify areas where you can cut back or save more effectively.