Step into the world of Financial wellness programs where the magic of financial stability meets the reality of workplace benefits. Get ready for a rollercoaster ride of insights and strategies that will transform the way you view employee well-being.

Let’s dive deep into the realm of financial wellness programs and discover how they can revolutionize the workplace environment.

Importance of Financial Wellness Programs

Financial wellness programs play a crucial role in the workplace by helping employees manage their money effectively, reduce financial stress, and improve their overall well-being. These programs are designed to educate and support employees in making informed financial decisions, leading to a more financially stable and secure workforce.

Benefits of Financial Wellness Programs

- Increased productivity: When employees are not worried about their finances, they can focus better on their work tasks and be more productive.

- Reduced absenteeism: Financial stress can lead to health issues that may cause employees to miss work. By providing financial wellness programs, employers can help reduce absenteeism.

- Improved morale: Employees appreciate when their employer invests in their financial well-being, which can boost morale and loyalty to the company.

Employee Retention

Financial wellness programs can also significantly impact employee retention rates. When employees feel supported in managing their finances, they are more likely to stay with a company that values their well-being. By offering these programs, employers can attract and retain top talent, ultimately reducing turnover costs and maintaining a stable workforce.

Components of Effective Financial Wellness Programs

Financial wellness programs can vary widely in their design and implementation, but there are several key components that can help make them effective in supporting employees’ financial health. Here are some key features that contribute to the success of financial wellness programs:

1. Personalized Financial Assessments

One approach to structuring financial wellness programs involves offering personalized financial assessments to employees. These assessments can help individuals identify their specific financial goals, challenges, and priorities, allowing for a more tailored approach to improving their financial well-being.

2. Educational Workshops and Resources

Another effective component of financial wellness programs is providing educational workshops and resources on various financial topics such as budgeting, saving, investing, and debt management. By offering these resources, employees can enhance their financial literacy and make more informed decisions about their finances.

3. Access to Financial Advisors

Some financial wellness programs provide employees with access to financial advisors or counselors who can offer personalized guidance and support. This one-on-one assistance can help employees address their specific financial concerns and develop strategies to achieve their financial goals.

4. Incentives and Rewards

Employers can also incorporate incentives and rewards into their financial wellness programs to motivate employees to actively participate and engage with the program. This can include offering bonuses, matching contributions to retirement accounts, or providing other financial incentives for achieving certain milestones.

5. Behavioral Economics Strategies

Using behavioral economics principles, such as nudges and reminders, can help encourage employees to make positive financial decisions and adopt healthy financial habits. By leveraging these strategies, employers can help employees overcome common behavioral barriers to financial well-being.

Implementation of Financial Wellness Programs

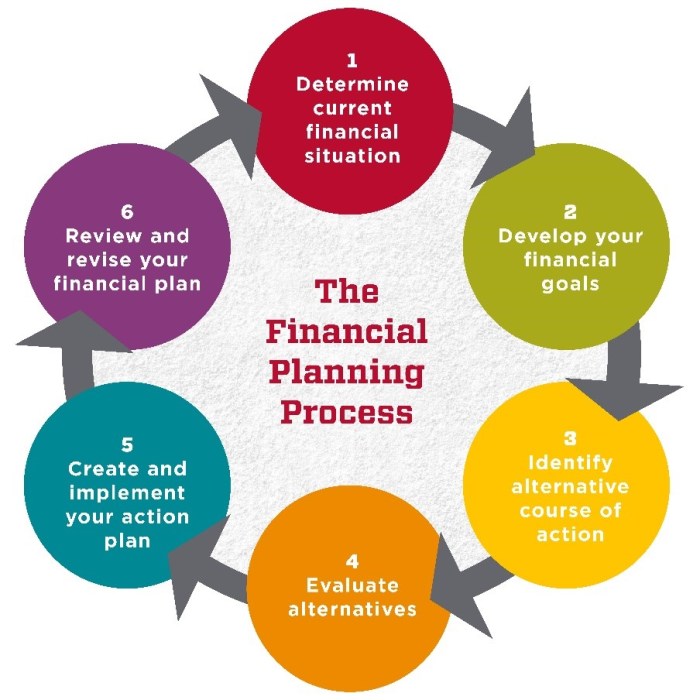

Implementing a financial wellness program in a company involves several key steps to ensure its success and effectiveness.

Steps Involved in Implementing a Financial Wellness Program

When introducing a financial wellness program, companies typically follow these steps:

- Assessing the current financial needs and challenges of employees through surveys or interviews.

- Collaborating with financial experts to design a customized program tailored to the specific needs of the employees.

- Launching the program with a comprehensive communication plan to ensure maximum participation and engagement.

- Providing ongoing support and resources to help employees improve their financial literacy and well-being.

- Measuring the impact of the program through feedback, surveys, and financial metrics to make necessary adjustments.

Common Challenges Faced When Introducing Financial Wellness Programs and How to Overcome Them

Some common challenges that companies may face when implementing financial wellness programs include:

- Lack of employee engagement and participation due to a lack of awareness or interest.

- Resistance from employees who may feel uncomfortable discussing their personal finances.

- Limited resources or budget constraints for implementing a comprehensive program.

Overcoming these challenges requires effective communication, education, and support from leadership to create a culture of financial well-being within the organization.

Examples of Successful Financial Wellness Program Rollouts in Organizations

Several organizations have successfully implemented financial wellness programs, such as:

- XYZ Company saw a 20% increase in employee engagement and productivity after introducing a financial wellness program that included personalized financial coaching and workshops.

- ABC Corporation implemented a budgeting and savings challenge that resulted in a 15% decrease in employee financial stress and an increase in retirement savings contributions.

Measuring the Impact of Financial Wellness Programs

Understanding how to measure the success and impact of financial wellness programs is crucial in determining their effectiveness and return on investment.

Key Metrics and Indicators

- Employee Engagement: Measure the level of employee participation and engagement in financial wellness programs through surveys, feedback, and attendance rates.

- Financial Stress Reduction: Evaluate the decrease in financial stress among employees by analyzing changes in absenteeism, turnover rates, and productivity levels.

- Financial Knowledge: Assess the improvement in employees’ financial literacy and knowledge through pre and post-program assessments.

- Savings and Retirement Contributions: Track the increase in employees’ savings rates and retirement contributions after participating in financial wellness programs.

Case Studies

Several companies have witnessed positive outcomes from implementing financial wellness programs:

Company A saw a 20% decrease in employee turnover and a 15% increase in productivity after introducing financial education workshops.

Company B reported a 25% increase in retirement plan participation and a 30% decrease in absenteeism following the implementation of personalized financial coaching sessions.