How to build a diversified portfolio is not just about investing; it’s about creating a financial roadmap that leads to success. From understanding the basics to mastering the art of asset allocation and risk management, this guide will navigate you through the intricate world of portfolio diversification.

Understanding Diversification: How To Build A Diversified Portfolio

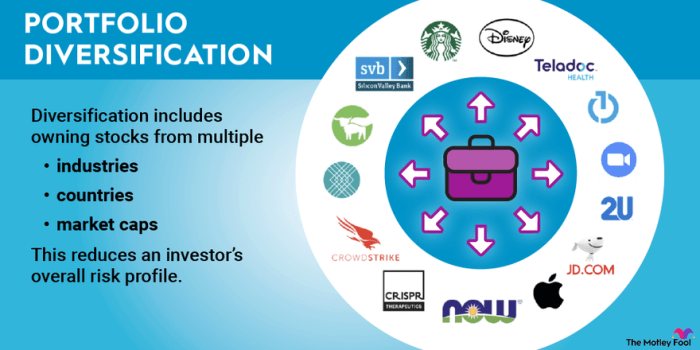

Diversification is a strategy used in investment where you spread your money across different types of assets to reduce risk. By not putting all your eggs in one basket, you can protect your portfolio from the impact of a single asset underperforming.

Examples of Risks Mitigated by Diversification

- Diversification helps mitigate the risk of loss from a single stock plummeting in value.

- It also reduces the impact of a specific industry experiencing a downturn.

- By investing in different asset classes like stocks, bonds, and real estate, you can lower the risk of losing all your money in one sector.

Benefits of a Diversified Portfolio

- Increased stability: Diversification can help smooth out the volatility in your portfolio.

- Lower risk: By spreading your investments, you lower the chance of significant losses due to the failure of one particular asset.

- Potential for higher returns: While diversification may not guarantee high returns, it can provide opportunities for growth across various assets.

Asset Allocation

When it comes to building a diversified portfolio, asset allocation plays a crucial role in spreading risk and maximizing returns. It involves deciding how to distribute your investments among different asset classes like stocks, bonds, real estate, and commodities.

Determining the Right Mix of Assets

- Consider your risk tolerance: Determine how comfortable you are with fluctuations in the value of your investments. Higher risk tolerance may lead to a higher allocation in stocks, while lower risk tolerance may lean towards bonds.

- Financial goals: Your investment objectives will influence the mix of assets in your portfolio. Whether you are saving for retirement, a house, or education can impact your asset allocation.

- Diversification benefits: By including a variety of asset classes, you can reduce the impact of market volatility on your portfolio. This can help achieve a more stable long-term return.

Role of Different Asset Classes

- Stocks: Offer potential for high returns but come with higher risk. They can provide growth and capital appreciation to your portfolio.

- Bonds: Generally considered safer than stocks, bonds offer income and stability. They can act as a cushion during market downturns.

- Real Estate: Provides diversification and a hedge against inflation. Real estate investments can offer rental income and potential for capital appreciation.

- Commodities: Include assets like gold, oil, and agricultural products. They can act as a hedge against inflation and provide diversification benefits.

Risk Management

Investing in financial markets always comes with a certain level of risk. However, diversification plays a crucial role in managing risk within an investment portfolio. By spreading investments across different asset classes, industries, and regions, investors can reduce the impact of potential losses from any one investment.

Asset Performance under Market Conditions

- Stocks: Stocks tend to perform well in a growing economy but can be volatile during economic downturns.

- Bonds: Bonds are considered safer investments with steady returns, especially during economic uncertainties.

- Real Estate: Real estate investments can provide a hedge against inflation and offer a steady income stream.

- Commodities: Commodities like gold or oil can act as a hedge against economic instability but can be influenced by global events.

Correlation Between Assets and Risk Management

- Positive Correlation: Assets that move in the same direction tend to have a positive correlation, increasing the overall risk in a portfolio.

- Negative Correlation: Assets that move in opposite directions have a negative correlation, providing a hedge against losses in one asset class.

- Zero Correlation: Assets with zero correlation offer diversification benefits as they are not influenced by each other’s performance.

Building a Diversified Portfolio

Building a diversified portfolio is crucial for managing risk and maximizing returns. It involves spreading your investments across different asset classes to reduce the impact of market fluctuations on your overall portfolio.

Step-by-Step Guidance, How to build a diversified portfolio

- Start by assessing your risk tolerance, time horizon, and financial goals.

- Determine the asset classes you want to include in your portfolio, such as stocks, bonds, real estate, and commodities.

- Allocate your assets based on your risk tolerance and investment objectives.

- Regularly monitor and rebalance your portfolio to maintain diversification.

Importance of Factors

- Time Horizon: Consider how long you plan to invest before needing the funds to determine your investment strategy.

- Liquidity Needs: Ensure you have enough liquid assets to cover any short-term expenses or emergencies.

- Financial Goals: Align your investment decisions with your long-term financial objectives to achieve success.

Tips for Rebalancing

- Set a schedule to review your portfolio regularly, such as quarterly or annually.

- Adjust your asset allocation based on market performance and changes in your financial situation.

- Sell overweighted assets and buy underweighted assets to rebalance your portfolio effectively.