How to build wealth sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset.

In today’s fast-paced world, understanding the ins and outs of wealth building is essential for securing a stable financial future. From setting financial goals to exploring different investment options, this guide will provide you with the tools and knowledge needed to pave your way to financial success.

Understanding Wealth Building

Building wealth is the process of accumulating assets and resources over time to achieve financial security and independence. It involves making smart financial decisions, investing wisely, and managing money effectively to increase one’s net worth.

Importance of Wealth Building

Building wealth is important for several reasons:

- Financial Security: Wealth provides a safety net in times of emergencies or unexpected expenses.

- Opportunities: Having wealth opens up opportunities for investments, business ventures, and personal growth.

- Legacy: Wealth can be passed down to future generations, creating a lasting impact on your family’s financial well-being.

Key Principles of Wealth Building

There are several key principles to keep in mind when building wealth:

- Save and Invest: Regularly save a portion of your income and invest in assets that generate passive income.

- Live Below Your Means: Avoid overspending and prioritize saving and investing over unnecessary expenses.

- Diversify Investments: Spread out your investments across different asset classes to reduce risk and maximize returns.

- Continuous Learning: Stay informed about financial trends, investment strategies, and opportunities for growth.

Setting Financial Goals

Setting financial goals is crucial when it comes to building wealth. It provides a clear roadmap for your financial journey and helps you stay focused and motivated along the way.

Short-term Financial Goals

- Building an emergency fund to cover unexpected expenses.

- Paying off high-interest debt to free up more money for saving and investing.

- Setting a budget and sticking to it to control spending.

Long-term Financial Goals

- Saving for retirement to ensure a comfortable future.

- Investing in assets like real estate or stocks to grow your wealth over time.

- Building a college fund for your children’s education.

Importance of Setting Goals in Wealth Building

Setting specific and achievable financial goals is essential for wealth building. It helps you track your progress, stay disciplined, and make informed decisions about where to allocate your money. Without clear goals, it’s easy to lose focus and get off track, hindering your ability to grow your wealth effectively.

Budgeting and Saving

Budgeting and saving are essential components of building wealth. By creating a budget and practicing good saving habits, individuals can take control of their finances and work towards achieving their financial goals.

Role of Budgeting in Wealth Building

Creating a budget is the foundation of wealth building. It allows individuals to track their income and expenses, identify areas where they can cut back, and allocate funds towards savings and investments. A budget helps in prioritizing financial goals and ensures that money is being used wisely to build wealth over time.

Tips for Creating an Effective Budget

- Start by tracking all income and expenses to get a clear picture of your financial situation.

- Set realistic goals for saving and spending, taking into account your income and financial obligations.

- Categorize expenses into fixed (rent, utilities) and variable (entertainment, dining out) to better manage and control spending.

- Regularly review and adjust your budget to reflect changes in income or expenses.

- Avoid unnecessary debt and prioritize paying off high-interest loans to free up more money for savings.

Strategies for Saving Money and Increasing Savings

- Automate your savings by setting up automatic transfers from your checking account to a savings or investment account.

- Cut back on unnecessary expenses such as dining out, subscription services, or impulse purchases.

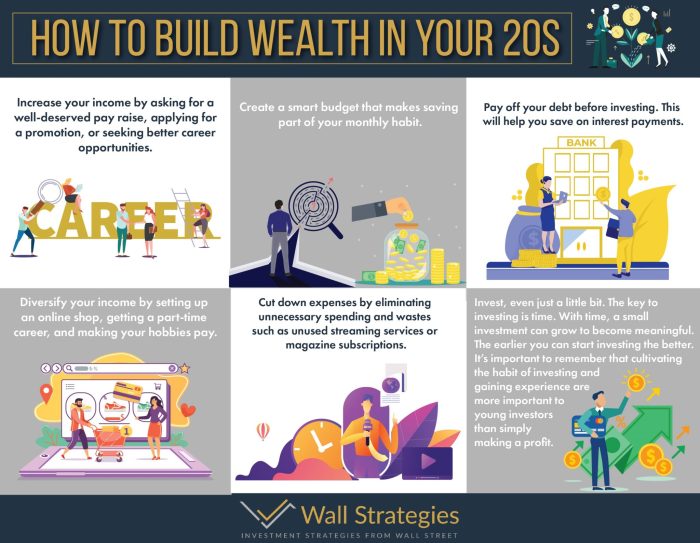

- Look for ways to increase your income through side hustles, freelance work, or seeking a higher-paying job.

- Take advantage of employer-sponsored retirement plans and contribute enough to receive any matching contributions.

- Consider setting up an emergency fund to cover unexpected expenses and avoid dipping into savings or using credit cards.

Investing for Wealth

Investing is a key strategy for building wealth over time. By putting your money into different investment options, you have the potential to earn returns that outpace inflation and grow your wealth significantly.

Different Investment Options

- Stocks: Investing in individual stocks can provide high returns, but also comes with higher risk.

- Bonds: Bonds are considered safer investments compared to stocks, offering fixed interest payments over time.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.

- Real Estate: Investing in real estate can provide rental income and potential property value appreciation.

Diversification in Investment

Diversification is a strategy where you spread your investments across different asset classes to reduce risk. By investing in a mix of stocks, bonds, real estate, and other assets, you can protect your portfolio from the impact of a single investment performing poorly.

Diversification is key to managing risk and maximizing returns in your investment portfolio.

Tips for Successful Investing to Build Wealth

- Start Early: The power of compounding allows your investments to grow over time, so start investing as soon as you can.

- Set Clear Goals: Define your financial goals and investment objectives to guide your investment decisions.

- Stay Informed: Keep up with market trends and investment news to make informed decisions about your portfolio.

- Regularly Review Your Portfolio: Rebalance your portfolio periodically to ensure it aligns with your risk tolerance and goals.

Generating Additional Income

In the journey to build wealth, having multiple income streams is crucial for financial stability and growth. By diversifying your sources of income, you can mitigate risks and increase your earning potential over time.

Importance of Multiple Income Streams

Having multiple income streams provides a safety net in case one source of income is disrupted. It also allows you to take advantage of different opportunities in various industries or markets. Here are some ideas on how to generate passive income and increase your income through side hustles or entrepreneurship:

- Investing in Real Estate: Owning rental properties can provide a steady stream of passive income through rent payments.

- Dividend Stocks: Investing in dividend-paying stocks allows you to earn regular income without actively working.

- Creating an Online Business: Starting an online store, blog, or e-commerce site can generate passive income through ads, affiliate marketing, or product sales.

Generating Passive Income

Generating passive income involves setting up systems or investments that require minimal effort to maintain while generating continuous income. Some ways to generate passive income include:

- Peer-to-Peer Lending: Investing in peer-to-peer lending platforms where you can earn interest on loans made to individuals or businesses.

- Creating Digital Products: Developing and selling digital products like e-books, online courses, or software can generate passive income once created.

- Investing in Index Funds: Investing in index funds or exchange-traded funds (ETFs) can provide passive income through dividends and capital appreciation.

Side Hustles and Entrepreneurship

Engaging in side hustles or entrepreneurship can help you increase your income beyond your primary job. Here are some ways to explore side hustles or start your own business:

- Freelancing: Offering your skills or services on freelance platforms can generate additional income on a flexible schedule.

- Start a Dropshipping Business: Setting up a dropshipping business allows you to sell products without holding inventory, reducing upfront costs.

- Consulting: Leveraging your expertise in a particular field to offer consulting services to individuals or businesses can be a lucrative side hustle.