Diving deep into the world of tracking expenses, this intro sets the stage for a wild ride filled with financial wisdom and savvy tips. Get ready to level up your money game!

Get ready to explore the ins and outs of monitoring your expenses like a pro.

Understanding the Importance of Tracking Expenses

Tracking expenses is crucial for financial management as it provides a clear picture of where your money is going. By keeping tabs on your spending habits, you can make informed decisions about your finances and identify areas where you can cut back or save.

Benefits of Tracking Expenses Regularly

- Helps you stay within budget: By tracking expenses regularly, you can ensure that you are not overspending and sticking to your financial goals.

- Identifies spending patterns: Tracking expenses allows you to see patterns in your spending behavior, helping you understand where your money is going each month.

- Encourages mindful spending: When you are aware of your expenses, you are more likely to think twice before making unnecessary purchases.

How Tracking Expenses Can Help in Budgeting Effectively

- Setting realistic budget goals: By tracking expenses, you can accurately assess how much you are spending in different categories and adjust your budget accordingly.

- Creating a spending plan: Tracking expenses helps you allocate your money wisely, ensuring that you have enough for essentials while also saving for future goals.

- Monitoring progress: Regularly tracking expenses allows you to monitor your progress towards financial milestones and make adjustments as needed to stay on track.

Different Methods of Tracking Expenses

![]()

Tracking expenses can be done in various ways, depending on personal preference and convenience. Let’s explore some of the common methods used by individuals to keep tabs on their spending.

Traditional Method: Pen and Paper

Using a pen and paper to track expenses is a classic method that involves jotting down every purchase made throughout the day. This method allows for a hands-on approach and provides a tangible record of spending habits. However, it can be time-consuming and may require manual calculations to analyze the data effectively.

Digital Method: Expense Tracking Apps

Expense tracking apps have gained popularity in recent years due to their convenience and accessibility. These apps allow users to input their expenses easily, categorize them, and generate reports automatically. With features like receipt scanning and budgeting tools, digital methods offer a more efficient way to manage finances. However, some may find it challenging to adapt to new technology or may have concerns about data privacy and security.

Comparison of Methods

- Pen and Paper:

- Advantages:

- Hands-on approach

- Tangible record of spending

- Disadvantages:

- Time-consuming

- Manual calculations

- Advantages:

- Expense Tracking Apps:

- Advantages:

- Convenience and accessibility

- Automated reports and budgeting tools

- Disadvantages:

- Adaptation to new technology

- Data privacy and security concerns

- Advantages:

Creating Categories for Expenses

When it comes to tracking expenses, creating categories can help you gain a better understanding of where your money is going. By organizing your expenses into specific categories, you can easily analyze your spending patterns and make informed decisions about where you may need to cut back or adjust your budget.

Common Expense Categories

- Groceries

- Utilities

- Entertainment

- Transportation

- Dining Out

Categorizing expenses allows you to see how much you are spending in each area of your life and identify opportunities for saving money.

Analyzing Spending Patterns

- By categorizing your expenses, you can quickly identify trends in your spending habits.

- This can help you prioritize where to allocate more or less money based on your financial goals.

- Tracking expenses by category can also reveal areas where you may be overspending and need to make adjustments.

Creating categories for expenses provides a clear picture of your financial habits and empowers you to make more informed decisions about your money.

Personalized Categories

- Consider your individual spending habits when creating categories.

- Customize categories to reflect your lifestyle and priorities.

- Don’t be afraid to adjust or add categories as needed to accurately track your expenses.

Personalizing expense categories can help you better manage your finances and stay on top of your budgeting goals.

Setting Up an Expense Tracking System

Setting up an effective expense tracking system is crucial for managing your finances efficiently. It involves a few key steps to ensure accuracy and consistency in tracking your expenses.

Steps to Set Up an Expense Tracking System

- Create a designated space or folder to store all your receipts and invoices.

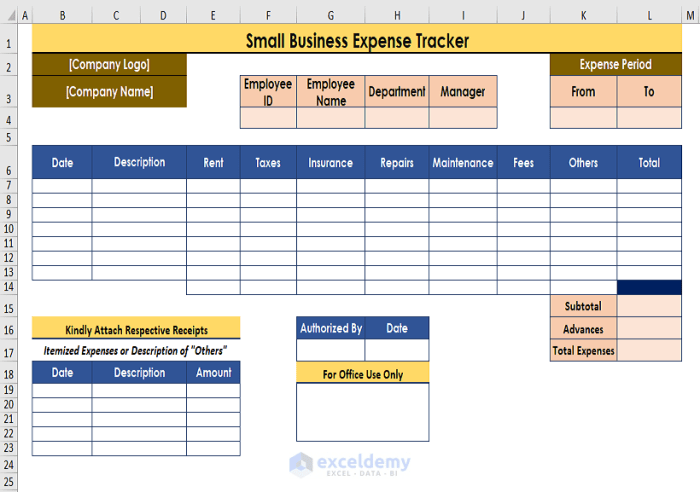

- Select a method of tracking expenses that works best for you, whether it’s through a spreadsheet, budgeting app, or specialized software.

- Establish categories for your expenses to easily classify and analyze your spending habits.

- Set a regular schedule to input your expenses into the tracking system to avoid missing any transactions.

- Review your tracked expenses periodically to identify areas where you can cut back or adjust your budget.

Importance of Consistency in Inputting Expenses

Consistency is key when it comes to inputting expenses into your tracking system. By recording all expenses promptly and accurately, you ensure that your financial data is up-to-date and reliable. This consistency will help you make informed decisions about your spending and budget adjustments.

Recommendations for Tools or Software

- Personal Finance Apps: Consider using apps like Mint, YNAB, or PocketGuard to automate expense tracking and categorization.

- Spreadsheets: Excel or Google Sheets are versatile tools for creating customized expense tracking templates to suit your specific needs.

- Receipt Scanning Apps: Apps like Expensify or Shoeboxed allow you to scan and digitize your receipts for easy expense management.

- Accounting Software: QuickBooks or FreshBooks are robust platforms for tracking expenses, especially for business owners or freelancers.

Analyzing and Reviewing Expense Reports

Analyzing and reviewing expense reports regularly is essential for maintaining financial health and making informed decisions about your spending habits. By carefully examining these reports, you can identify areas where expenses can be reduced or optimized, ultimately helping you save money and reach your financial goals.

Identifying Areas for Expense Reduction

- Review recurring expenses: Look for subscriptions or services you no longer use and consider canceling them.

- Track variable expenses: Identify patterns in your spending and find ways to cut back on non-essential items.

- Compare against budget: Check if your actual spending aligns with your budget and adjust as needed.

Tips for Reviewing Expense Reports

- Set aside dedicated time: Schedule regular intervals to review your expense reports thoroughly.

- Use technology: Utilize expense tracking apps or software to streamline the process and gain insights into your spending habits.

- Look for trends: Identify recurring expenses or spikes in spending to pinpoint areas where you can make changes.