Yo, diving into Planning for healthcare costs in retirement, this intro will give you the lowdown on why it’s crucial to think about healthcare expenses as you chill in your retirement years. Get ready for some real talk about budgeting and insurance options that can impact your golden years.

So, let’s break it down and get you prepped for the healthcare costs you might face down the road.

Understanding Healthcare Costs in Retirement

Healthcare costs in retirement refer to the expenses individuals incur for medical care and related services after they stop working. Planning for these costs is crucial to ensure financial stability and access to necessary healthcare services.

Importance of Planning for Healthcare Costs

Planning for healthcare costs in retirement is essential because medical expenses tend to increase as individuals age. Failing to plan adequately can lead to financial strain and impact the quality of care retirees receive.

Common Healthcare Expenses in Retirement

- Doctor visits and consultations

- Prescription medications

- Hospital stays and surgeries

- Dental and vision care

- Long-term care services

Impact of Inflation on Healthcare Costs

Healthcare costs are subject to inflation, which means that prices for medical services and treatments are likely to rise over time. Retirees need to account for inflation when planning for healthcare expenses to ensure they can afford necessary care in the future.

Factors Affecting Healthcare Costs

When planning for healthcare costs in retirement, it is crucial to consider various factors that can influence the overall expenses. Understanding these factors can help retirees make informed decisions and better manage their healthcare costs.

Factors that Influence Healthcare Costs in Retirement

- Health Condition: The state of one’s health plays a significant role in determining healthcare costs. Chronic conditions or unexpected illnesses can lead to higher medical expenses.

- Age: As individuals age, they may require more frequent medical care and treatments, resulting in increased healthcare costs.

- Lifestyle Choices: Factors like diet, exercise, and smoking can impact overall health, potentially affecting healthcare costs in retirement.

- Medical Technology: Advancements in medical technology can offer new treatments and procedures, but they may come with a higher price tag.

Comparison of Healthcare Costs Across Different Retirement Living Scenarios

- Aging in Place: Retirees who choose to stay in their own homes may incur costs for in-home care services, modifications for accessibility, and medical equipment.

- Assisted Living: Moving to an assisted living facility can provide additional support but comes with monthly fees that cover accommodation, meals, and healthcare services.

- Nursing Home: Nursing homes offer round-the-clock care, but they tend to be the most expensive option due to the intensive level of medical care provided.

Impact of Location on Healthcare Expenses During Retirement

- Cost of Living: Healthcare costs can vary significantly depending on the cost of living in a particular region, impacting expenses for medical services, prescription drugs, and insurance premiums.

- Access to Healthcare Providers: Rural areas may have fewer healthcare providers, leading to higher costs for travel or telehealth services.

- State Regulations: Different states have varying regulations on healthcare services and insurance coverage, which can affect costs for retirees.

Role of Insurance Coverage in Managing Healthcare Costs in Retirement

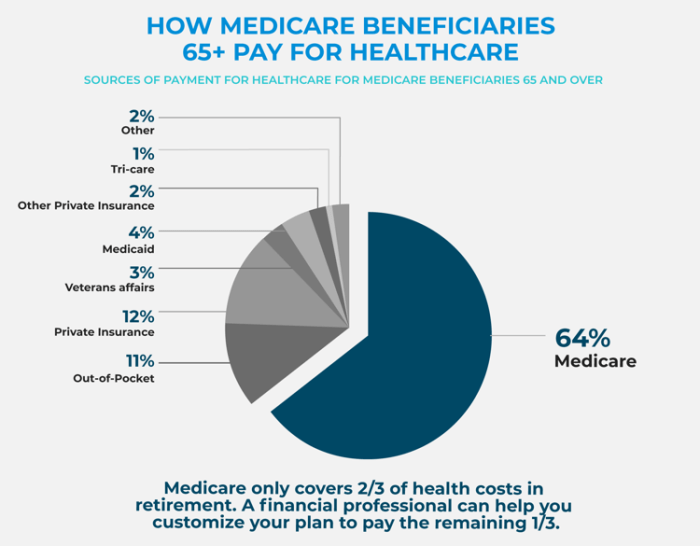

- Medicare: Retirees are eligible for Medicare coverage, but they may still need supplemental insurance to cover additional expenses not included in the basic plan.

- Medicaid: For retirees with limited income and resources, Medicaid can help cover healthcare costs, but eligibility requirements vary by state.

- Private Health Insurance: Some retirees opt for private health insurance plans to supplement Medicare or provide additional coverage for specific healthcare needs.

Creating a Healthcare Budget for Retirement

To plan for healthcare costs in retirement, it is essential to create a budget that estimates your future expenses. By considering factors like inflation, medical conditions, and potential emergencies, you can better prepare for your healthcare needs in retirement.

Estimating Healthcare Expenses in Retirement

- Start by reviewing your current healthcare expenses and projecting how they might change as you age.

- Consider the cost of Medicare premiums, co-pays, prescription drugs, and any supplemental insurance you may need.

- Factor in potential long-term care costs, such as nursing home care or home health aides.

- Account for unexpected medical emergencies or surgeries that could impact your budget.

Sample Budget for Healthcare Costs in Retirement

| Expense Category | Estimated Cost |

|---|---|

| Medicare Premiums | $300 per month |

| Prescription Drugs | $150 per month |

| Supplemental Insurance | $200 per month |

| Long-Term Care | $5,000 per month |

Strategies to Save and Invest for Future Healthcare Needs

- Open a Health Savings Account (HSA) to save pre-tax dollars for medical expenses in retirement.

- Invest in a diversified portfolio that includes healthcare-related stocks and bonds to grow your wealth.

- Consider purchasing long-term care insurance to protect your assets from high care costs in the future.

Importance of Reviewing and Adjusting Healthcare Budgets Regularly

Regularly reviewing and adjusting your healthcare budget ensures that you are prepared for any changes in medical costs or coverage. By staying informed and proactive, you can make necessary adjustments to your budget to meet your evolving healthcare needs in retirement.

Healthcare Insurance Options for Retirees

Picking the right healthcare insurance as a retiree is crucial for financial security and peace of mind. Here we break down some of the main options available to help you make an informed decision.

Medicare

Medicare is a federal health insurance program primarily for people aged 65 and older. It consists of Part A (hospital insurance) and Part B (medical insurance), with the option to enroll in Part D for prescription drug coverage.

Medigap

Medigap plans, also known as Medicare Supplement Insurance, help cover the gaps in Medicare coverage, such as copayments, coinsurance, and deductibles. These plans are offered by private insurance companies.

Long-Term Care Insurance

Long-term care insurance provides coverage for services not covered by traditional health insurance or Medicare, such as assistance with daily living activities in a nursing home or at home. It can help protect your assets in the event of needing long-term care.

Tips for Choosing the Right Insurance Plans

- Assess your healthcare needs and budget to determine which coverage is most essential for you.

- Compare premiums, deductibles, copayments, and coverage limits across different plans.

- Consider factors like network coverage, prescription drug coverage, and provider choices when making your decision.

Implications of Not Having Adequate Insurance Coverage

Not having sufficient insurance coverage in retirement can lead to high out-of-pocket costs, limited access to healthcare services, and financial strain on your savings. It’s crucial to evaluate your options and choose a plan that suits your individual needs to avoid potential risks.