Portfolio diversification, a key strategy for investors looking to optimize their financial gains while minimizing potential losses, involves spreading investments across different asset classes. This smart move can lead to a more resilient and profitable portfolio. Get ready to dive into the world of smart investing!

Importance of Portfolio Diversification

Diversifying a portfolio is crucial for investors as it helps spread out risk across different asset classes, industries, and geographic regions. This strategy can help protect against significant losses if one particular investment underperforms or faces challenges.

Reducing Risk

Portfolio diversification can reduce risk in several ways:

- Diversification across asset classes (stocks, bonds, real estate) can help offset losses in one asset class with gains in another.

- Investing in different industries can protect against sector-specific downturns or disruptions.

- Geographic diversification can mitigate risks associated with political instability or economic events in one region.

Potential Benefits in Returns

While diversification may not guarantee high returns, it can potentially enhance overall returns by:

- Minimizing the impact of poor performance in one investment on the entire portfolio.

- Providing opportunities for growth in different sectors or regions that outperform others.

- Helping investors stay invested for the long term by reducing the emotional impact of market volatility.

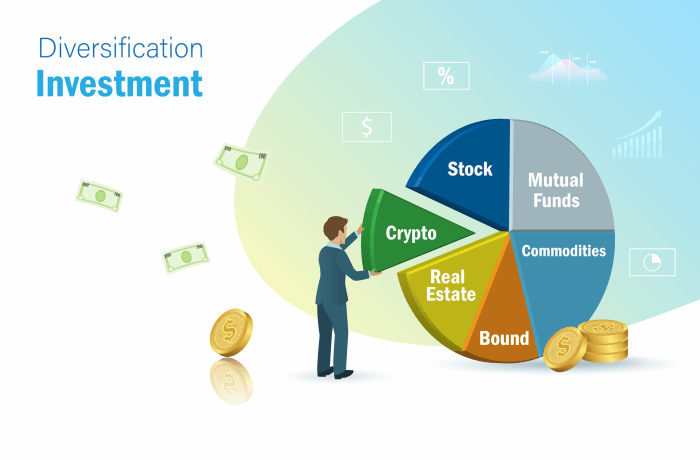

Types of Assets for Diversification

When it comes to diversifying your portfolio, it’s crucial to consider different types of assets. By spreading your investments across various asset classes, you can reduce risk and potentially improve overall performance.

Stocks

Stocks represent ownership in a company and are considered high-risk, high-reward investments. They offer the potential for capital appreciation through increased stock prices and dividends.

Bonds

Bonds are debt securities issued by governments or corporations. They are generally considered safer than stocks and offer a fixed income in the form of regular interest payments.

Real Estate

Real estate investments involve purchasing properties such as residential homes, commercial buildings, or land. They can provide rental income and the potential for property appreciation over time.

Commodities, Portfolio diversification

Commodities include physical goods such as gold, oil, and agricultural products. Investing in commodities can help diversify a portfolio and provide a hedge against inflation.

Alternative Investments

Alternative investments encompass a wide range of assets such as hedge funds, private equity, and cryptocurrencies. These investments can offer unique opportunities for diversification but also come with higher risk. Diversifying across various asset types can help reduce the impact of market fluctuations on your portfolio. Each asset class has its own risk-return profile, and by combining different assets, you can potentially achieve a more balanced and resilient investment portfolio.

Strategies for Effective Diversification: Portfolio Diversification

When it comes to diversifying your portfolio, one key concept to understand is correlation. Correlation measures the relationship between the price movements of different assets. By investing in assets that have low or negative correlation, you can reduce the overall risk of your portfolio.

Correlation in Portfolio Diversification

Correlation is a statistical measure that ranges from -1 to 1. A correlation of 1 means the assets move in perfect tandem, while a correlation of -1 indicates they move in opposite directions. Assets with a correlation close to 0 have little to no relationship in their price movements.

- Example of correlation:

Stocks and bonds typically have a low or negative correlation. When stocks are down, bonds may be up, providing a hedge against losses.

- Another example:

Gold and the US Dollar usually have a negative correlation. When the dollar weakens, gold prices tend to rise.

Using Correlation for Diversification

Investors can use correlation to build a well-diversified portfolio by combining assets that have low or negative correlation. This helps spread risk across different asset classes and reduces the impact of market fluctuations on the overall portfolio.By analyzing the historical correlation between assets, investors can make informed decisions on how to allocate their investments effectively.

Risk Management through Diversification

Diversification plays a crucial role in managing investment risk by spreading your investments across different asset classes. This reduces the impact of negative events on any single investment, helping to protect your overall portfolio.

Relationship between Risk and Return in a Diversified Portfolio

In a diversified portfolio, the relationship between risk and return is balanced. By including a mix of assets with different risk levels, you can potentially increase returns while lowering overall risk. For example, while stocks may offer higher returns, bonds can provide stability during market downturns.

Real-world Scenarios of Risk Mitigation through Diversification

- During the 2008 financial crisis, investors with diversified portfolios that included bonds, real estate, and international stocks were better able to weather the storm compared to those heavily invested in just one asset class like U.S. stocks.

- Similarly, in 2020 when the COVID-19 pandemic caused market volatility, portfolios with a mix of assets like gold, treasury bonds, and technology stocks were able to offset losses in other sectors.