Get ready to dive deep into the world of Understanding income statements, where financial jargon meets real-world applications. Buckle up as we unravel the complexities and unveil the hidden gems of income statements in a way that’s both educational and entertaining.

Let’s kick things off by exploring the fundamental concepts and practical implications behind income statements.

Introduction to Income Statements

An income statement, also known as a profit and loss statement, is a financial report that summarizes a company’s revenues, expenses, and profits over a specific period of time. It provides information on the profitability and financial performance of a business.

Key Components of an Income Statement

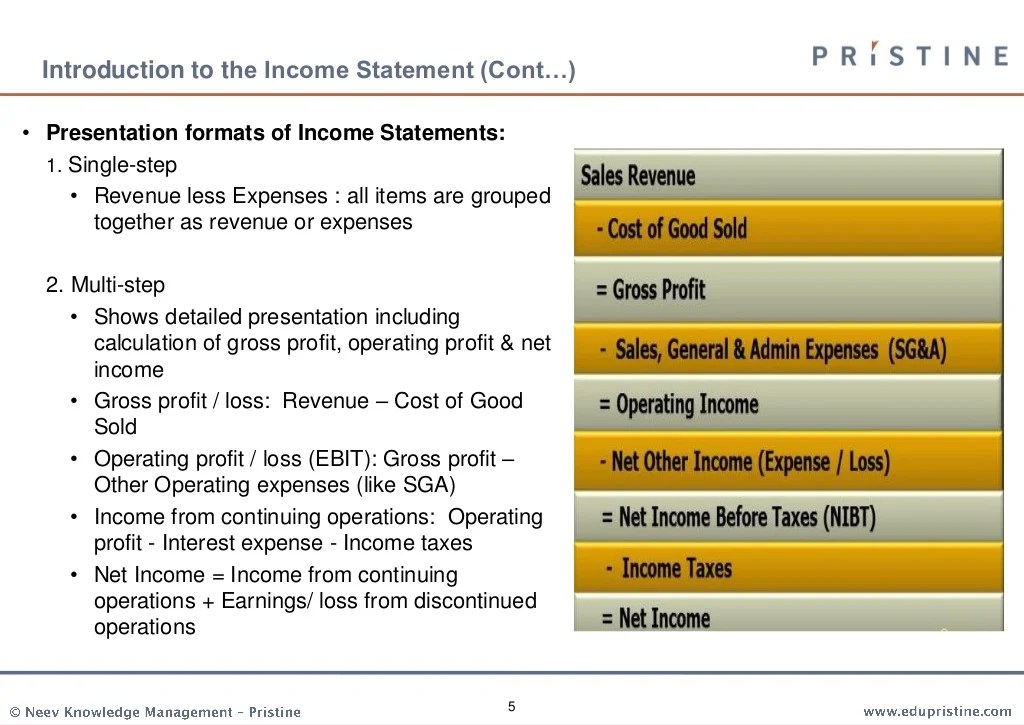

- Revenue: This represents the total amount of money generated from the sale of goods or services.

- Expenses: These are the costs incurred by the company to generate revenue, including operating expenses, interest expenses, and taxes.

- Net Income: This is the final figure after subtracting expenses from revenue, indicating the company’s profit or loss for the period.

- Gross Profit: Calculated by subtracting the cost of goods sold from revenue, it shows the profitability before deducting other expenses.

- Operating Income: This is the profit generated from the company’s core business operations, excluding interest and taxes.

Reading and Interpreting Income Statements

Understanding how to read an income statement effectively is crucial for assessing a company’s financial performance. An income statement provides a snapshot of a company’s revenues and expenses over a specific period, usually quarterly or annually.

Significance of Revenue and Expenses

Revenue represents the income generated from the company’s primary business activities, while expenses are the costs incurred to generate that revenue. The difference between revenue and expenses is the company’s net income, which indicates its profitability.

- Revenue Section: The revenue section of an income statement shows the total income generated by the company. Higher revenue typically indicates growth and a healthy business.

- Expenses Section: The expenses section Artikels the costs incurred to generate revenue. Monitoring expenses is crucial to ensure they do not exceed revenue, impacting profitability.

- Net Income: The net income is the bottom line of the income statement, reflecting the company’s overall profitability. Positive net income signifies a profitable company, while negative net income indicates losses.

Financial Health Indicators

Various sections of an income statement can provide insights into a company’s financial health:

- Gross Profit Margin: Calculated by subtracting the cost of goods sold from revenue and dividing by revenue. A higher gross profit margin indicates efficient operations.

- Operating Income: Reflects the company’s profitability from core operations. Consistent growth in operating income signals a healthy business.

- Net Income Margin: Calculated by dividing net income by revenue. A higher net income margin signifies better cost management and profitability.

Analyzing Income Statements

Analyzing income statements is crucial for understanding a company’s financial health and performance. By examining various financial ratios derived from income statements, investors and analysts can make informed decisions about the company’s profitability and overall success.

Common Financial Ratios

Financial ratios provide valuable insights into a company’s financial position and performance. Some common ratios used to analyze income statements include:

- Profit Margin: Calculated by dividing net income by total revenue, this ratio indicates how much of each dollar in revenue translates to profit.

- Return on Assets (ROA): This ratio measures how efficiently a company is using its assets to generate profit.

- Return on Equity (ROE): By comparing net income to shareholders’ equity, this ratio shows how effectively a company is using shareholder investments to generate profit.

Profitability Ratios

Profitability ratios focus on a company’s ability to generate profit relative to its revenue, assets, and equity. Comparing and contrasting profitability ratios derived from an income statement can provide a comprehensive view of a company’s financial performance. Some key profitability ratios include:

- Gross Profit Margin: Calculated by subtracting the cost of goods sold from total revenue and dividing by total revenue, this ratio shows how efficiently a company is managing its production costs.

- Operating Profit Margin: This ratio measures a company’s operating efficiency by comparing operating income to total revenue.

- Net Profit Margin: By dividing net income by total revenue, this ratio provides insight into a company’s overall profitability after all expenses are accounted for.

Insights from Trends

Analyzing income statements over multiple periods can reveal important trends and insights into a company’s performance. By identifying changes in revenue, expenses, and profitability over time, investors can assess how well a company is adapting to market conditions and managing its operations. Trends in income statements can also highlight areas of strength or weakness that may impact future financial performance.

Importance of Income Statements for Stakeholders

Income statements play a crucial role for various stakeholders in assessing a company’s financial performance and making informed decisions. Let’s delve into how income statements are essential for investors, creditors, and management.

Investors’ Perspective

Income statements are a key tool for investors to evaluate a company’s profitability and growth potential. By analyzing revenue, expenses, and net income over a specific period, investors can make informed decisions on whether to buy, hold, or sell a company’s stock. They can assess the company’s financial health and performance trends, helping them make strategic investment choices.

Creditors’ Point of View

For creditors, income statements provide valuable insights into a company’s creditworthiness and ability to repay debts. By examining the company’s profitability, liquidity, and debt levels, creditors can determine the risk involved in lending money to the company. A strong income statement with consistent profits and healthy cash flow signals to creditors that the company is financially stable and capable of meeting its financial obligations.

Management Decision-Making

Income statements are essential for management in making strategic decisions to drive the company’s growth and profitability. By analyzing income statements, management can identify areas of strength and weakness in the company’s operations. They can make informed decisions on cost-cutting measures, revenue-generating strategies, and overall business planning based on the financial performance reflected in the income statement.