Diving into the world of mutual fund fees, we uncover the nitty-gritty details that can impact your investment returns. Get ready to explore the ins and outs of different fee structures in the finance game.

Get your calculators ready because we’re about to break down the complexities of mutual fund fees like never before.

Types of Mutual Fund Fees

When investing in mutual funds, it’s important to understand the various fees that can impact your returns. Here are the different types of fees associated with mutual funds:

Front-End Loads

Front-end loads are fees charged when you purchase mutual fund shares. These fees are deducted from your initial investment, reducing the amount of money actually being invested. For example, if you invest $1,000 in a mutual fund with a 5% front-end load, only $950 will actually be invested.

Back-End Loads

Back-end loads are fees charged when you sell your mutual fund shares. These fees are typically a percentage of the value of the shares being sold. For instance, if you sell $1,000 worth of shares with a 3% back-end load, you would only receive $970.

Management Fees

Management fees are ongoing fees paid to the fund’s manager for managing the investments. These fees are usually a percentage of the fund’s assets under management. For example, if a mutual fund has $1 million in assets and a management fee of 1%, the annual fee would be $10,000.

12b-1 Fees

12b-1 fees are marketing and distribution fees charged by some mutual funds. These fees are used to cover the costs of promoting the fund and compensating brokers. They are typically included in the fund’s expense ratio. For example, if a fund has a 0.25% 12b-1 fee, it means that $25 will be deducted annually for every $10,000 invested.

Understanding Expense Ratios

In the world of mutual funds, expense ratios play a crucial role in determining the overall cost of investing. These ratios are important metrics for investors to consider as they directly impact the returns they can expect from their investments.

Definition of Expense Ratios

An expense ratio is a measure of the total costs associated with managing and operating a mutual fund, expressed as a percentage of the fund’s average net assets. It includes various fees such as management fees, administrative fees, and other operational expenses incurred by the fund.

Calculation and Importance of Expense Ratios

Expense ratios are calculated by dividing the total expenses of a mutual fund by its average net assets. This percentage represents the amount of money investors pay each year to cover the fund’s operating expenses.

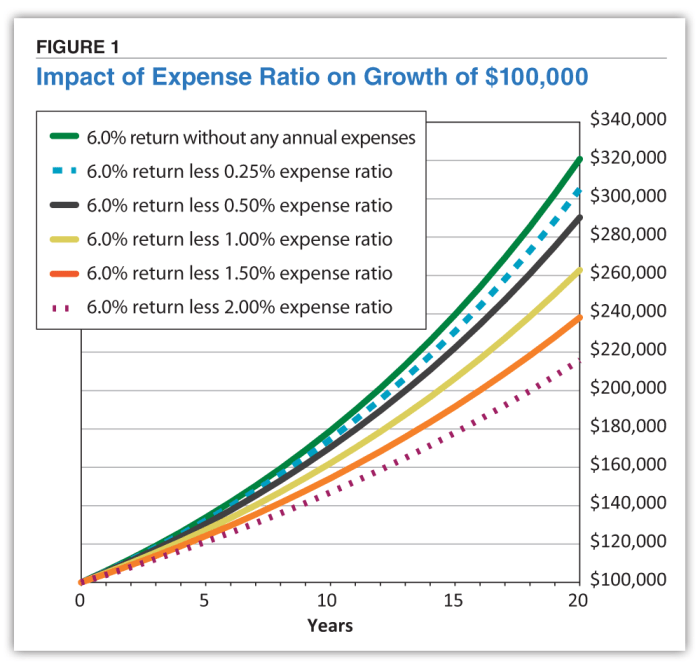

It is essential for investors to consider expense ratios because lower ratios mean more of their investment returns stay in their pockets. Over time, even a small difference in expense ratios can have a significant impact on the overall returns of an investment.

Variability of Expense Ratios and Impact on Investments

Expense ratios can vary significantly between different mutual funds based on their size, investment strategy, and management style. Actively managed funds often have higher expense ratios compared to passively managed index funds.

Investors should carefully evaluate expense ratios when choosing mutual funds to ensure they are not paying more than necessary for similar investment options. Keeping expense ratios low can enhance the long-term growth potential of investments.

Fee Structures and Impact on Returns

When it comes to mutual fund investments, fee structures play a crucial role in determining the overall returns for investors. Understanding how fees are deducted and the impact they have on investment growth is essential for making informed financial decisions.

Fees on mutual funds are typically deducted from the fund’s assets in various ways, such as through expense ratios, sales charges, and redemption fees. These fees are used to cover the costs of managing the fund, including administrative expenses, advisory fees, and marketing expenses. The way fees are structured can significantly affect the net returns that investors receive.

Breakdown of Fee Deductions

- Expense Ratios: These are ongoing fees charged as a percentage of the fund’s assets to cover operating expenses. A higher expense ratio means a larger portion of the fund’s returns are being used to cover these costs.

- Sales Charges: Also known as loads, these fees are paid when buying or selling shares of a mutual fund. Front-end loads are deducted when purchasing, while back-end loads are charged when selling.

- Redemption Fees: These fees are imposed when investors redeem their shares within a specified time frame. They are meant to discourage frequent trading and can impact overall returns.

Even seemingly small differences in fees can have a significant impact on investment growth over time.

For example, let’s consider two mutual funds with similar performance but different fee structures. Fund A has an expense ratio of 1%, while Fund B has an expense ratio of 0.5%. If both funds generate a 6% return in a year, Fund A would provide a net return of 5% after fees, whereas Fund B would provide a net return of 5.5%. Over time, this seemingly small difference can lead to a significant variance in the final investment value.

Disclosure Requirements and Transparency

Transparency is key when it comes to understanding mutual fund fees. Regulatory requirements ensure that investors have access to crucial information about the fees associated with their investments. This disclosure is essential for investors to make informed decisions and assess the overall cost of investing in a particular mutual fund.

Regulatory Requirements for Fee Disclosure

In the United States, the Securities and Exchange Commission (SEC) mandates that mutual funds disclose their fees in a clear and concise manner. This includes all the costs involved in investing in the fund, such as management fees, operating expenses, and any other charges that may impact returns. By providing this information, investors can better understand the total cost of their investment and compare different funds more effectively.

- Fee Breakdown: Mutual funds are required to provide a breakdown of all fees and expenses associated with the fund, including any sales charges or loads.

- Prospectus: Investors can access detailed information about fees in the fund’s prospectus, which is a legal document that Artikels key details about the fund.

- Annual Reports: Mutual funds also disclose their fees in annual reports, providing investors with updated information on the costs of investing in the fund.

Importance of Transparency for Investors

Transparency in fee disclosures allows investors to evaluate the true cost of investing in a mutual fund. By understanding the fees involved, investors can assess whether the fund’s performance justifies the costs and make more informed investment decisions. Additionally, transparency helps investors avoid any hidden fees or charges that may impact their returns over time.

- Comparative Analysis: Access to fee information enables investors to compare different mutual funds and choose the one that offers the best value.

- Long-Term Planning: Transparent fee disclosures help investors plan for the long term by factoring in all costs associated with their investments.

- Educational Tool: Understanding fees can serve as an educational tool for investors, empowering them to take control of their investment decisions.

Accessing Information and What to Look Out For

Investors can access information about mutual fund fees through various channels, including the fund’s website, prospectus, and regulatory filings. When reviewing fee disclosures, investors should pay attention to the fee structure, expense ratios, and any potential conflicts of interest that may impact the fund’s performance.

- Fee Structure: Understand how fees are calculated and whether they are fixed or variable based on the fund’s assets under management.

- Expense Ratios: Compare expense ratios across different funds to assess the impact of fees on returns.

- Conflicts of Interest: Look out for any conflicts of interest that may influence the fund’s fee structure or investment decisions.