Get ready to dive into the world of value investing, where financial wisdom meets strategic decision-making. This guide will equip you with the knowledge needed to navigate the complex landscape of investments, uncovering hidden gems in the stock market.

From understanding the fundamental principles to exploring different strategies, this comprehensive overview will empower you to make informed choices and unlock the potential for long-term financial success.

Definition of Value Investing

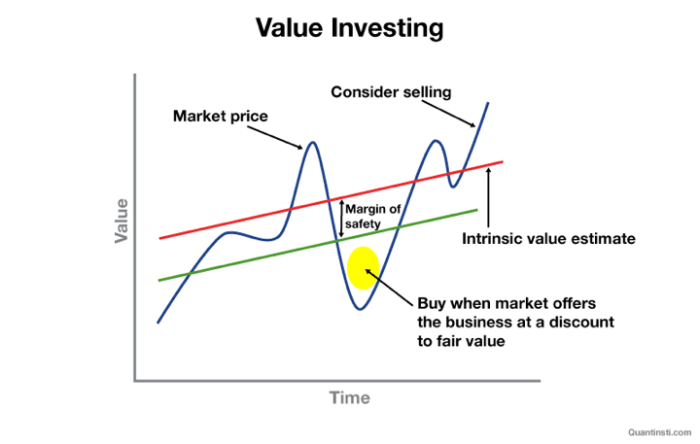

Value investing is a strategy where investors carefully analyze stocks to find those that are trading at a lower price than their intrinsic value. The goal is to buy these undervalued stocks and hold onto them for the long term, expecting their value to eventually be recognized by the market.

Key Principles of Value Investing

- Investing in companies with solid fundamentals and strong financials.

- Buying stocks that are trading below their intrinsic value.

- Having a long-term investment horizon.

- Being patient and disciplined in decision-making.

- Focusing on the margin of safety to protect against downside risk.

Successful Value Investors and Strategies

- Warren Buffett: Known as the “Oracle of Omaha,” Buffett is one of the most successful value investors. His strategy involves finding companies with durable competitive advantages and holding onto them for the long term.

- Benjamin Graham: Considered the father of value investing, Graham’s strategy focused on buying stocks when they were trading below their intrinsic value and using a margin of safety to protect against losses.

- Seth Klarman: Klarman is known for his patient and disciplined approach to value investing. He looks for opportunities where the market has mispriced a stock and takes advantage of these discrepancies.

Fundamental Analysis in Value Investing

Fundamental analysis plays a crucial role in value investing, as it involves evaluating the financial health and performance of a company to determine its intrinsic value.

Importance of Financial Ratios

Financial ratios are essential in evaluating investment opportunities as they provide insights into a company’s profitability, liquidity, efficiency, and solvency. Some key financial ratios used in fundamental analysis include:

- Price-to-Earnings (P/E) ratio

- Debt-to-Equity ratio

- Return on Equity (ROE)

- Current Ratio

Assessing Intrinsic Value of a Stock

To assess the intrinsic value of a stock using fundamental analysis, investors often use methods like Discounted Cash Flow (DCF) analysis or comparing the stock’s current price to its fair value based on earnings and growth prospects. By analyzing a company’s financial statements and using these valuation techniques, investors can make informed decisions on whether a stock is undervalued or overvalued in the market.

Value Investing vs. Growth Investing

When it comes to investing, there are two main approaches that investors can take: value investing and growth investing. While both strategies aim to generate profits in the stock market, they have distinct differences in their philosophies and methods.

Value investing focuses on finding undervalued stocks trading below their intrinsic value. Investors following this approach believe that the market sometimes misprices stocks, providing opportunities to buy them at a discount. Value investors typically look for companies with solid fundamentals, stable earnings, and low price-to-earnings ratios.

On the other hand, growth investing focuses on companies that exhibit strong growth potential, even if their current stock prices may seem high. Growth investors are willing to pay a premium for stocks of companies that are expected to grow rapidly in the future. These investors prioritize revenue growth, market share expansion, and cutting-edge innovation.

Key Differences

- Value investors seek stocks that are undervalued, while growth investors target stocks with high growth potential.

- Value investing emphasizes intrinsic value and fundamental analysis, whereas growth investing focuses on future growth prospects and market trends.

- Value investors tend to have a longer time horizon and are more risk-averse, while growth investors may have a shorter time frame and are willing to take on more risk.

Advantages and Disadvantages

- Value Investing:

- Advantages:

- Historically proven to be a successful long-term investment strategy.

- Provides a margin of safety by investing in undervalued stocks.

- Disadvantages:

- May require patience as undervalued stocks can take time to realize their full potential.

- Could miss out on high-growth opportunities in fast-paced industries.

- Advantages:

- Growth Investing:

- Advantages:

- Potential for high returns from investing in rapidly growing companies.

- Opportunity to capitalize on emerging trends and disruptive technologies.

- Disadvantages:

- Higher risk due to investing in companies with elevated valuations.

- Greater volatility in stock prices, especially during market downturns.

- Advantages:

Margin of Safety in Value Investing

Margin of safety in value investing refers to the principle of buying assets at a discount to their intrinsic value, providing a cushion against potential losses. It acts as a safety net for investors by allowing them to purchase securities below their true worth, reducing the risk of permanent capital impairment.

Calculation and Application of Margin of Safety

To calculate the margin of safety, investors typically subtract the intrinsic value of an asset from its current market price. The larger the difference between the intrinsic value and the market price, the greater the margin of safety. This approach helps investors protect themselves from unforeseen events or market fluctuations that could negatively impact the investment.

- Identify the intrinsic value of the asset through fundamental analysis, including factors like earnings, cash flow, and assets.

- Determine the current market price of the asset.

- Calculate the margin of safety by subtracting the market price from the intrinsic value.

- Consider investing when the margin of safety is significant, indicating a higher level of potential return relative to risk.

Margin of Safety = Intrinsic Value – Current Market Price

Protection from Losses with Margin of Safety

Having a margin of safety can protect investors from losses in various ways. For example, if there is a market downturn or a company’s performance deteriorates, the cushion provided by the margin of safety can help offset potential losses. Additionally, it allows investors to buy assets with a built-in discount, increasing the chances of achieving a positive return even if the market conditions change.

- During economic downturns, the margin of safety helps prevent significant losses as the asset was purchased at a discount.

- If a company underperforms, the margin of safety provides a buffer against declines in the stock price.

- Investors can have peace of mind knowing that they have a margin of safety in their investments, reducing the impact of unforeseen events.

Value Investing Strategies

Value investing strategies are essential for investors looking to maximize their returns by identifying undervalued stocks and holding them for the long term. By using different strategies like contrarian investing and deep value investing, value investors can take advantage of market inefficiencies and generate superior returns.

Contrarian Investing

Contrarian investing involves going against the crowd and investing in stocks that are currently unpopular or undervalued by the market. This strategy relies on the belief that market sentiment can often be wrong, leading to mispriced assets. Value investors practicing contrarian investing look for opportunities where the market has overreacted to negative news or events, creating buying opportunities.

Deep Value Investing

Deep value investing focuses on finding stocks trading at a significant discount to their intrinsic value. Investors using this strategy often look for companies that are temporarily out of favor, experiencing financial distress, or are undervalued due to market conditions. By conducting thorough fundamental analysis, deep value investors aim to identify opportunities where the market has underestimated the true worth of a company.

Identifying Undervalued Stocks

- Look for companies with strong fundamentals but trading at a discount to their intrinsic value.

- Consider stocks with low price-to-earnings (P/E) ratios or price-to-book (P/B) ratios compared to industry peers.

- Examine the company’s competitive position, management team, and growth prospects to assess its long-term potential.

Importance of Long-Term Perspective

Having a long-term perspective is crucial in value investing as it allows investors to ride out short-term market fluctuations and benefit from the compounding effect of returns over time. By focusing on the underlying value of a company and its potential for growth, value investors can make informed decisions that align with their investment goals and risk tolerance.